Relocating Homebuyers Look Far Afield, Redfin Reports

(Courtesy Redfin)

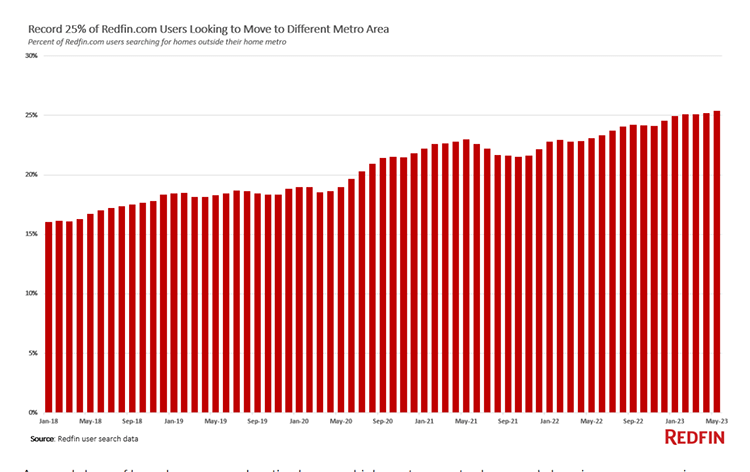

More than one-quarter of homebuyers nationwide are looking to move to a different metro area, reported Redfin, Seattle.

The figure increased from 23% a year ago and less than 20% before the pandemic.

The Redfin Housing Migration Report said a record share of homebuyers are relocating because high mortgage rates have made housing more expensive than ever, which makes relatively affordable areas more attractive. Phoenix, Las Vegas and Miami—where the typical home is much less expensive than coastal cities such as San Francisco and New York—are the most popular metros for homebuyers moving to a different part of the country.

But that doesn’t mean more homebuyers are looking to relocate, Redfin noted. In fact, the number of homebuyers moving to a new metro is down 7% from a year ago, the biggest decline on record, as elevated mortgage rates push many Americans out of the homebuying game entirely. Still, out-of-town moves are holding up better than in-town moves: The number of homebuyers looking to move within their current hometown is down a record 18%.

“In other words, the overall homebuying pie has shrunk, but buyers moving to a new metro make up the biggest piece of that pie on record,” the report said.

Phoenix is the most popular destination for homebuyers looking to move to a different part of the country, followed by Las Vegas and several Florida metros, Redfin said. Popularity is determined by net inflow, a measure of how many more Redfin.com users looked to move into an area than leave.

Sun Belt metros are popular among relocating homebuyers because many of them are affordable compared to other parts of the U.S. The typical home in Phoenix, for instance, sells for $450,000. That’s up significantly from before the pandemic because remote work made the area explode in popularity, but remains about half the $800,000 cost of the typical home in Seattle, the most common origin of people moving to Phoenix.

Even though the flow of homebuyers moving into Phoenix has slowed as high mortgage rates have cooled the housing market, it’s still attracting more out-of-towners than anywhere else in the U.S. That’s in spite of Phoenix facing worsening drought and heat risk. Arizona recently said it will stop issuing homebuilding permits in some parts of the Phoenix desert, partly because migration to the area and extensive development is straining water resources. That will cap the number of new communities in the Phoenix area and could eventually increase the cost of housing.

Most of the other popular destinations for homebuyers also face extreme climate risks; for instance, parts of the Sacramento area face high wildfire danger and many Florida metros are susceptible to flooding. Some insurance companies have even stopped providing coverage to homeowners in California and Florida due to high risk of damage by natural disasters.

“Climate risks haven’t yet stopped many homebuyers from moving into areas that don’t have enough water, like Phoenix, and places that could eventually be underwater, like coastal Florida,” Redfin Chief Economist Daryl Fairweather said. “That’s because even though Sun Belt home prices soared during the pandemic, those metros remain a bargain for people relocating from expensive coastal cities. Arizona’s recent limit on new construction isn’t likely to deplete inventory enough or push prices up enough to change that calculus much in the short term.”