Owning a Home Still Important in Vision of ‘Good Life,’ Survey Says

(Courtesy Fannie Mae)

Fannie Mae recently relaunched a series of survey questions–most recently asked in fourth-quarter 2020–on how consumers define “the good life.” The agency’s takeaway? Little has changed, and aspirations to homeownership remain high, despite rising interest rates and home prices.

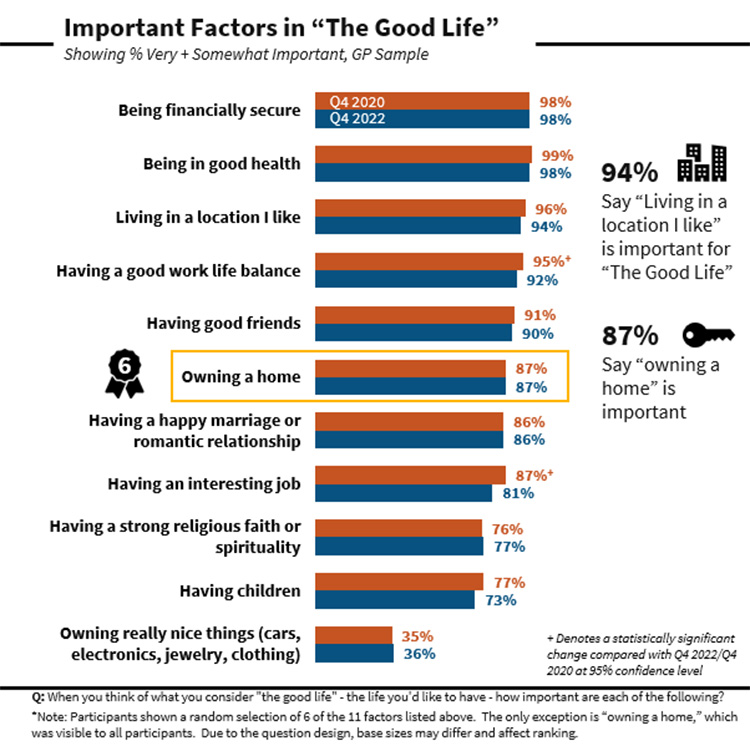

Between Q4 2020 and Q4 2022, the percent of consumers who cited owning a home as an important factor in “the good life” (defined by Fannie Mae as “the life they’d like to have”) remained flat, at 87% and at No. 6 on the respondents’ list. In a similar vein, 94% said living in a location they like was part of “the good life,” down a little bit from 96% in 2020.

Topping the list was “being financially secure” and “being in good health,” both at 98%.

One of the few notable changes over the past two years is related to the perception of renting vs. owning, per a perspective piece from Fannie Mae’s Kevin Tillmann, Market Research Senior Associate, National Housing Survey, and Steve Deggendorf, Market Research Senior Director.

Researchers asked respondents what benefits come from buying over renting a home. “Having less stress” brought up the rear at 66%, but still a 10-percentage-point jump from 2020.

“It was particularly true among renters (60% in 2022 compared to 40% in 2020). One possible explanation is that many renters have experienced significant rent price increases and, despite declining home purchase affordability, view a fixed mortgage payment as less stressful,” Tillmann and Deggendorf said. “Another is that homeownership may be perceived as offering greater privacy and security than renting, a lifestyle benefit that may have proved especially desirable three years into a pandemic.”

The top three concepts in which buying was viewed as preferable to renting were: control over what you do with your living space (94%); a sense of privacy and security (91%) and having a good place for your family/to raise children (90%).

The study also broke down some demographics, finding a greater share of Hispanic renters (92%) consider homeownership to be important compared with Black renters (79%) and White renters (74%).

However, in another change over the past two years, 88% of Black consumers viewed “living in a place where you and your family feel safe” as a benefit of homeownership over renting, higher than two years ago at 72%. Consumers as a whole were also at 88%, up from 83%, on that metric.

In terms of the percentage of respondents who believed buying a home is a safe investment, 76% of homeowners thought so in 2022 compared with 59% of renters. Those numbers also remained fairly flat from 2020.

“Given the consistency of our survey results, we expect consumers’ longstanding and highly favorable attitude toward homeownership as an investment option will continue to persist, even in the face of possible recession,” Tillmann and Deggendorf said. “Finally, in further support of homeownership’s enduring appeal, our data showed clear nonfinancial benefits to owning a home, as well, that we believe provide additional dimensions of value for consumers that, for the most part, other financial assets do not confer.”