MBA Research Roundup June 2023

Each month, MBA Research releases a roundup of recent data, activities and other pertinent developments crucial to the real estate finance industry.

Click here for more information regarding MBA Research products.

Now Available: June 2023 MBA Mortgage Finance and Economic Forecasts.

MBA Research Spotlight

Federal Reserve Maintains Federal Funds Rate

On June 14, the Federal Reserve, in its ongoing efforts to slow inflation, held the federal funds rates at a target range of 5.00-5.25%.

- The FOMC said, “Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

- MBA’s SVP and Chief Economist Mike Fratantoni noted, “Inflation is coming down, but slowly. Multiple indicators suggest the economy here and abroad, will slow significantly in the near term, but the job market continues to appear resilient in the most recent data. With this muddled picture, it is not surprising that the FOMC held rates steady at its June meeting – but kept their options open for July and later this year. Nevertheless, we expect that the Fed is at the top of its rate hiking cycle.”

For more information, contact Mike Fratantoni at (202) 557-2935.

Recent MBA Data/Releases/Commentary

Click on a headline to read more:

- June 1, 2023: Commercial and Multifamily Mortgage Delinquency Rates Increased in the First Quarter of 2023

- June 2, 2023: May Jobs Report Commentary from MBA’s Mike Fratantoni

- June 7, 2023: Mortgage Applications Decrease in Latest MBA Weekly Survey

- June 13, 2023: Mortgage Credit Availability Decreased in May

- June 14, 2023: Mortgage Applications Increase in Latest MBA Weekly Survey

- June 14, 2023: FOMC Commentary from MBA’s Mike Fratantoni

- June 20, 2023: May New Home Purchase Mortgage Applications Increased 16.6 Percent

- June 20, 2023: Share of Mortgage Loans in Forbearance Decreases to 0.49% in May

- June 21, 2023: Mortgage Applications Increase in Latest MBA Weekly Survey

- June 28, 2023: Mortgage Applications Increase in Latest MBA Weekly Survey

- June 29, 2023: Mortgage Application Payments Increased 2.5 Percent to $2,165 in May

MBA Speaking Engagements:

- July 10, 2023: IMB Networking Group Webinar: Performance Benchmarking – Marina Walsh

- July 11, 2023: MBA CEO Listening Tour – Membership Meeting, Chicago, IL – Marina Walsh

- July 19, 2023: MBA Bank Senior Executive Roundtable – Jamie Woodwell

- July 26, 2023: MBA’s Condominium Lending Summit 2023– Joel Kan

To register for MBA’s events and conferences, click here.

Upcoming MBA Speaking Engagements

- July 13, 2023: FHFA Speaker Series – Jamie Woodwell

- July 18, 2023: American Legal and Financial Network (ALFN) 21st Annual Conference – ANSWERS – Marina Walsh

- July 24, 2023: Corelogic’s CoreConnect Fast Forward – Mike Fratantoni

- July 26, 2023: Deephaven Mortgage – Mike Fratantoni

What MBA Research is Reading

- “Preparing for the Final Collapse of the Soviet Union and the Dissolution of the Russian Federation“

- “Speech by Governor Bowman on bank regulation and supervision“

- “Making Monetary Policy amid Financial System Challenges“

- “Response to FHFA Pricing RFI | HOWARD ON MORTGAGE FINANCE“

- “THE STATE OF THE NATION’S HOUSING 2023“

- “Exposing the Top Misconceptions About Climate Physical Risk in Real Estate“

- “Why Economies Haven’t Slowed More Since Central Banks Hit the Brakes“

- “Large, creative AI models will transform lives and labour markets“

- “Not Just “Stimulus” Checks: The Marginal Propensity to Repay Debt“

MBA Research in the News

- New York Times – What’s happening in the Housing Market?

- Multi-Housing News – Commercial and Multifamily Mortgage Delinquency Rates Increased in the First Quarter of 2023

- CNBC – Mortgage demand grows, driven by sales of new homes

- Business Insider – Today’s Mortgage, Refinance Rates: June 22, 2023 | Rates Finally Drop

- DSNews – Servicers’ Forbearance Volume Dips to Three-Year-Low

- National Mortgage News – With recession still expected, MBA cuts origination forecast

- CNBC – Weekly mortgage demand flat, interest rates drop for the third straight week

- Barron’s – Mortgage Rates Slide for Second Week in a Row

- HousingWire – Mortgage credit availability tightened in May

- Bloomberg – US Mortgage Applications for Home Purchases Drop for a Fourth Week

- CBS News – When will mortgage interest rates drop? Here’s what experts think

- Fox Business – Mortgage rates bump up as Fed holds grip on economic policy: Freddie Mac

- GOBankingRates – Will Mortgage Rates Drop in 2023? Experts Forecast

- National Mortgage News – Commercial mortgage delinquencies rise in 1Q

- CNN – US mortgage rates climb to their highest level since November

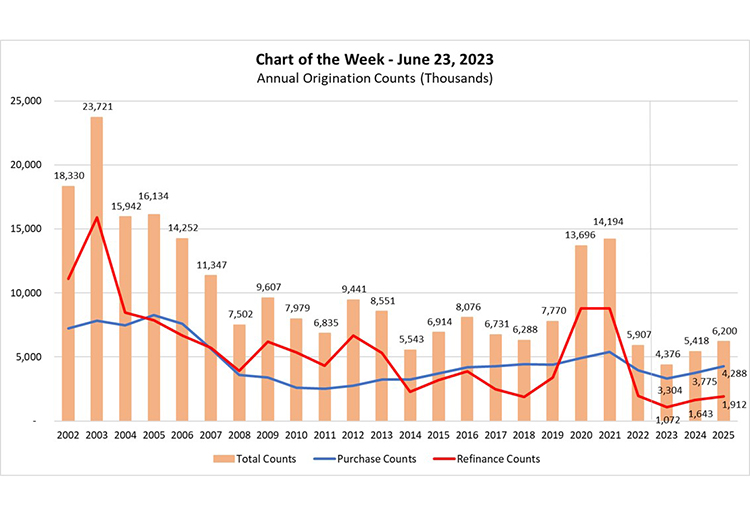

June Charts of the Week (Our favorite from this month is shown below:)

- June 2, 2023: Commercial and Multifamily Mortgage Delinquency Rates Among Different Capital Sources

- June 9, 2023: Annual House Price Change by State

- June 16, 2023: Mortgage Credit Availability Index (NSA, Mar-12=100)

- June 23, 2023: Annual Originations Counts (Thousands)

Subscribe to MBA’s Chart of the Week here.

Recent MBA Research Blogs/Videos

Note: Be sure to share MBA’s Research Roundup with industry colleagues and subscribe here.