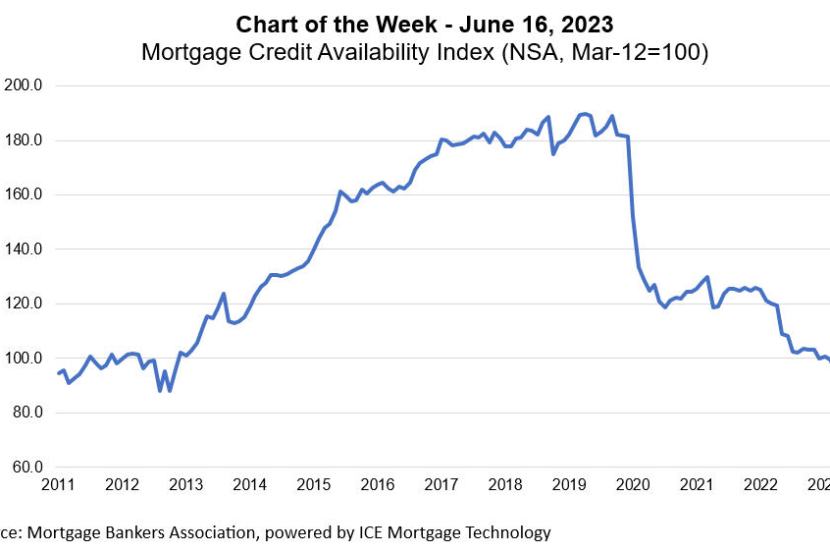

MBA Chart of the Week June 20, 2023: Mortgage Credit Availability Index

(Source: Mortgage Bankers Association, powered by ICE Mortgage Technology

According to data from MBA’s May 2023 Mortgage Credit Availability Index (MCAI), we saw the third consecutive month of declining credit availability, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market. These factors brought the MCAI to its lowest level since January 2013 and the index was around 20 percent lower than the same month a year ago. The index accounts for the number of different types of loan programs investors are willing to purchase and the credit criteria of those programs in order to gauge overall credit availability to borrowers.

Similar to the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) data, there has been noticeable credit tightening in 2023. For example, a growing share of respondents reported tighter credit for both GSE-eligible and government residential loans in the first two quarters of 2023.

Delving into the MCAI components, the Conforming index decreased almost 4 percent to its lowest level in the history of the survey, dating back to 2011. The Jumbo index fell by 1.5 percent last month, its first contraction in three months, as depositories’ balance sheets remained under stress from deposit outflows, reducing their appetite for jumbo loans.

Lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan application activity remains extremely low – home purchase applications are almost 30 percent behind last year’s pace, and refinance activity lags by more than 40 percent. There is typically some expansion of credit when volumes are low, as there is more competition for the limited volume in the market, but that is not the case in the current environment. Both Conventional and Government indexes indices saw declines last month as well, and the Government index fell by 3.8 percent to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers and affordability challenges remain a hurdle for many, this downward trend in government credit is particularly significant.