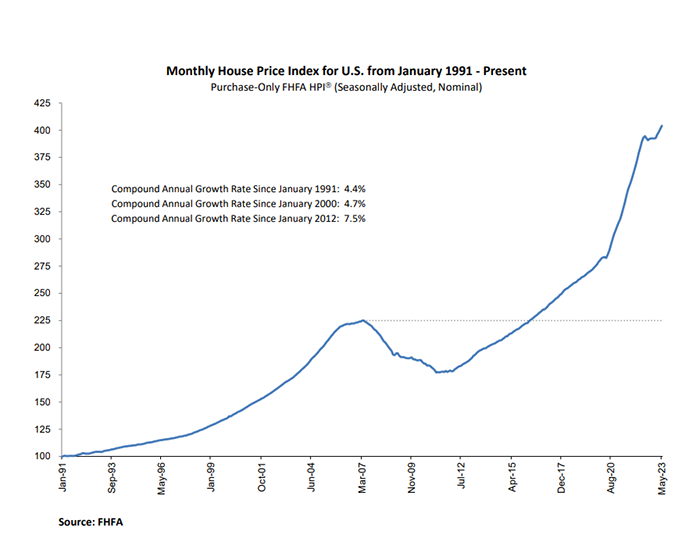

FHFA Finds House Prices Up 0.7% in May; 2.8% from Last Year

(Courtesy FHFA)

U.S. house prices rose in May, up 0.7 percent from April, the Federal Housing Finance Agency’s seasonally adjusted monthly House Price Index reported.

FHFA said house prices rose 2.8 percent between May 2022 and May 2023.

“U.S. house prices increased moderately in May, continuing the trend of the last few months,” said Nataliya Polkovnichenko, supervisory economist in FHFA’s Division of Research and Statistics. “However, house prices in some regions of the country remained below the levels seen one year ago.”

For the nine census divisions, seasonally adjusted monthly price changes from April 2023 to May 2023 ranged from -0.5 percent in the New England division to +1.7 percent in the Pacific division. The 12-month changes were -2.7 percent in the Mountain division to +5.5 percent in the East North Central division.

In a separate report, CoreLogic Case-Shiller issued its Home Price Index, which found a 50 basis point drop from a year ago. “Some surprising cities are now the hottest housing markets, Cleveland, Chicago, and Detroit,” the report said. “Also, some bright spots are appearing in the south where more inventory is available, including new construction.”

CoreLogic Chief Economist Selma Hepp noted May was the second consecutive month of year-over-year losses. “However, while the annual decline reflects price drops that occurred in 2022, recent above-average price gains indicate an inflection ahead,” she said. “And while home sales activity still continues to tell a tale of two markets: one of the West, which is constrained by a lack of existing inventory, and the other of the Southeast and South, where the availability of new homes for sale is creating sales opportunities; home prices are not necessarily following the trend anymore.”

Hepp said prices in many previously declining West Coast markets are rebounding and showing some renewed vigor, “particularly as those are also most constrained with a lack of homes for sale.”

CoreLogic also found that competition among buyers is increasing the share of homes selling over the asking price. That figure reached 39% in May compared to 25% on average pre-pandemic. “As a result, median price premium–ratio of sale price to list price–is back to positive, at 1%, after declining since last September,” Hepp said.