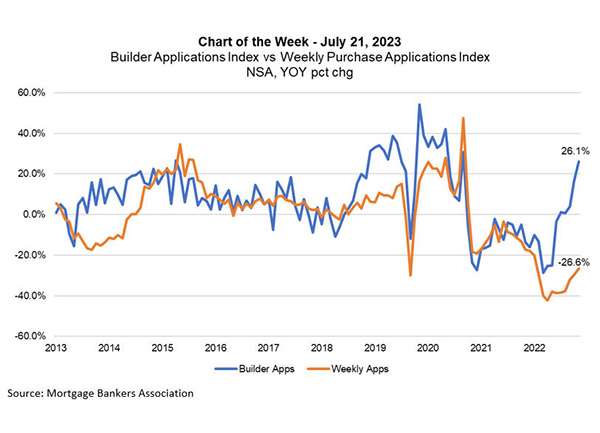

MBA Chart of the Week July 24: Divergence Between Existing and New Home Sales

(Source: Mortgage Bankers Association)

The divergence between existing and new home sales activity continues to grow. This MBA Chart of the Week compares data from our Builder Applications Survey (BAS), which captures home purchase applications on newly constructed homes taken by mortgage companies affiliated with home builders, and the Weekly Applications Survey (WAS), which covers a broader sample of lenders who originate loans in the retail and consumer direct channels.

The purchase applications from the WAS are predominantly for existing homes. The contrast in recent results is stark – the BAS, as of June 2023, shows a 26% annual increase in purchase applications, the fifth consecutive month of annual growth, while the WAS purchase index continues to show annual declines, with the June level of applications down almost 27% relative to a year ago.

Existing-home sales activity remains suppressed by low levels of for-sale inventory, which sits at just over 1 million units – a 3.1-month supply and about half the historical average, based on data from the NAR. Many homeowners are holding onto mortgage rates significantly lower than currently available rates, which is dissuading them from listing their homes for sale. This is adding to the drag on overall purchase activity, even with buyers willing to purchase in the current rate environment.

Sales of newly built homes on the other hand, continue to show robust growth. Homebuilders continue to work through any remaining backlogs to construction, and Census data show that the inventory of new homes for sale, at 428,000 units as of May 2023, now represents about a third of all single-family units for sale. Home buyers have turned to new homes as an option if previously owned homes are not available or in their price range, not only because of the relative availability of new homes but also because of the prospect of a newer, higher quality home. This is especially the case given the tradeoff of a higher mortgage rate.

We expect this trend to continue in the near term, given the recent uptick in single-family housing starts and upward trend in permit activity over the past several months. In the medium term, however, as interest rates decrease, we forecast that existing-home sales will increase from the June annual rate of 4.16 million to a 4.6 million unit pace in 2024. Moreover, in the longer term, an aging baby boomer population (who make up about 40% of homeowners) will gradually exit their current homes, further increasing the for-sale inventory of existing homes.