FundingShield Finds Wire, Title Fraud Big Risk in Q2

(Image courtesy FundingShield)

FundingShield, Newport Beach, Calif., reported wire and title fraud concerns persist at high levels so far this year, finding 50.2% of loans on a $68 billion portfolio in the second quarter had at least one risk issue.

The firm noted that problematic loans had, on average, almost two issues per loan, pointing to a lack of appropriate controls by closing agents. The number of loans with issues is up 12.6% in the first half of this year compared with last year.

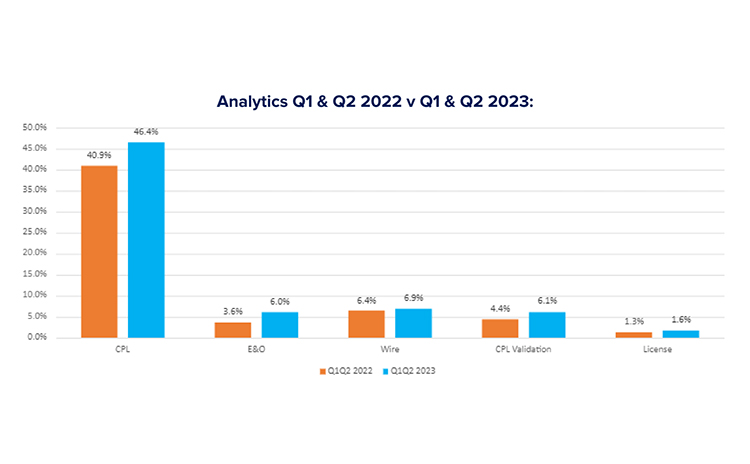

There was a 6.5% increase in Closing Protection Letter-related errors such as data mismatches that lead to additional work post-closing from the first half of 2023 compared with the same period in 2022, and a 4.7% increase in issues with proof of insurance.

Moreover, Q2 saw a record high for agent licensing and good-standing issues. FundingShield reported 15% more agents are failing to keep their licenses active with states and insurance commissioners compared with Q1. Also, 6.7% of agents sent leaders a CPL that wasn’t registered or had incorrect data, up 22% from last quarter.