RCLCO: Sentiment Improves, but Still Points to Recession Worries

(Courtesy RCLCO)

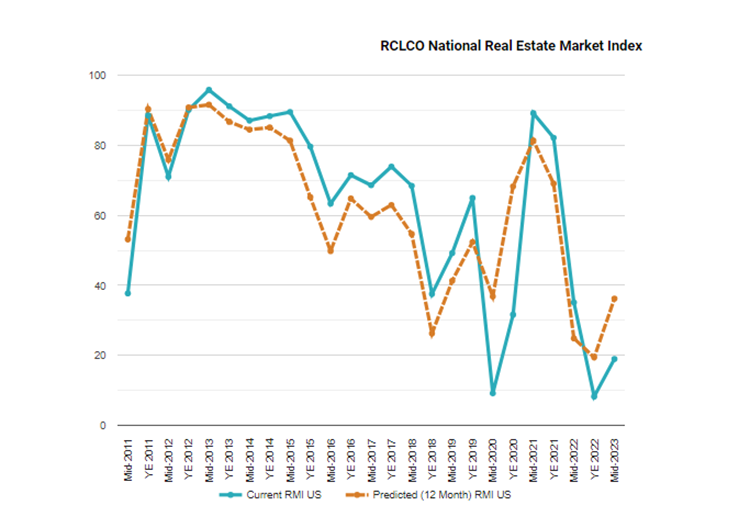

RCLCO, Washington, D.C., said its mid-year Sentiment Survey found an uptick in its Current Real Estate Market Sentiment Index to 19 from a low of 8.3 at the end of 2022. However, survey respondents still believe a recession is likely, even as many measures slowly begin to improve.

The score of 19 remains firmly in the zone indicating challenging market conditions–anything below 40 is consistent with a period of real estate market distress. Respondents believe the market will continue to improve but remain under that threshold, as the Future RMI is predicted to increase 17.2 points to 36.2 over the next year.

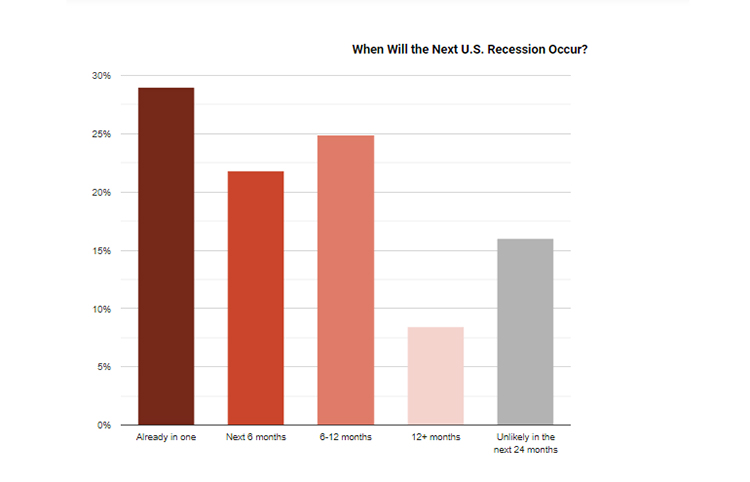

Eighty-four percent of respondents believe a national economic recession is imminent within the next two years, but a majority believe it will be shallow or moderate. They also expect most real estate sectors to be in some stage of downturn over the next 12 months, although that varies by sector.

Respondents said the for-sale housing sector is in downturn mode, but there is optimism as interest rates stabilize. Most reported rental housing has entered the early downturn stage. But, in more mixed news, most predicted that housing overall will be in the expansionary mode again within the next six to 12 months.

The office sector was anticipated to top the list with the largest weighted peak-to-trough value decline.

The survey also found capital flows to real estate and homeownership rates are anticipated to fall over the next year, but 47% of respondents also believe that inflation will begin to decrease.