Mortgage Capital Trading: Lock Volume Increases 31% Month-over-Month

(Courtesy MCT)

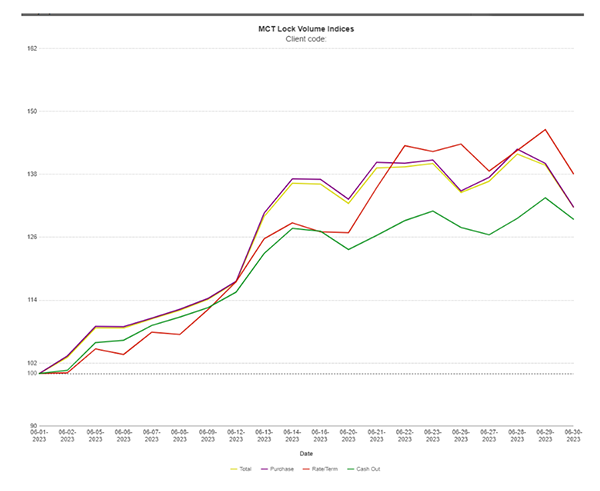

Mortgage Capital Trading, San Diego, reported a 31% increase in lock volume in June after a dip in May.

The increase in June’s lock volume activity, which is based on actual locked loans, comes after a 15% drop in May’s total lock production, noted Andrew Rhodes, Senior Director and Head of Trading at MCT.

“We saw originations toward the end of May slow down, so this is likely a summertime pickup in originations,” Rhodes said. “Rates, housing supply, and affordability will continue to be the forces behind the lack of new originations.”

Rhodes noted the meeting minutes from the Federal Reserve Open Market Committee’s decision to pause hikes in June show some disagreement and additional rate hikes are expected, which may continue to keep origination volume at a new normal. “The current commentary coming from the Fed puts the market on its heels as there is a potential for another two rate hikes this year,” he said.

The June MCT Indices also showed a nearly 8% drop in total lock volume from this time last year. “After hitting lows at the beginning of the year for purchase, rate/term refinance, and cash out refinance, each production type continues to creep slowly upward,” the report said.

Upcoming economic reports will continue to have a big impact on the Fed’s decision making and market movements, Rhodes said. “If labor markets cool off, that could give the Fed a reason not to raise rates in July,” he said. “This would provide a nice bounce in the markets, but I’m not holding my breath.”

MCT’s Rate Lock Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across diverse lenders (e.g., sizes, products/services offered, business models).