Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and make changes in response to the recent large bank failures. MBA strongly opposes certain provisions of the proposal.

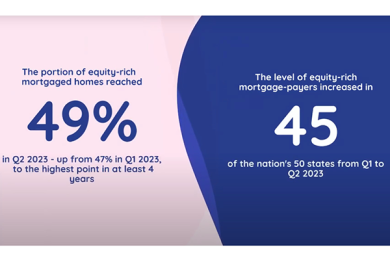

Homeowner Equity Improves in Second Quarter

ATTOM, Irvine, Calif., reported nearly half--49%--of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023.

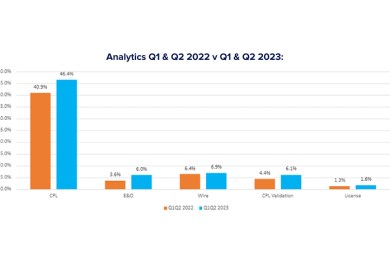

FundingShield Finds Wire, Title Fraud Big Risk in Q2

FundingShield, Newport Beach, Calif., reported wire and title fraud concerns persist at high levels so far this year, finding 50.2% of loans on a $68 billion portfolio in the second quarter had at least one risk issue.