CBRE Senior Housing Survey Finds Mostly Higher Cap Rates

(Courtesy CBRE)

CBRE, Dallas, reported all but one seniors housing category had a higher average cap rate year-over-year, with the average seniors housing cap rate up by 26 basis points.

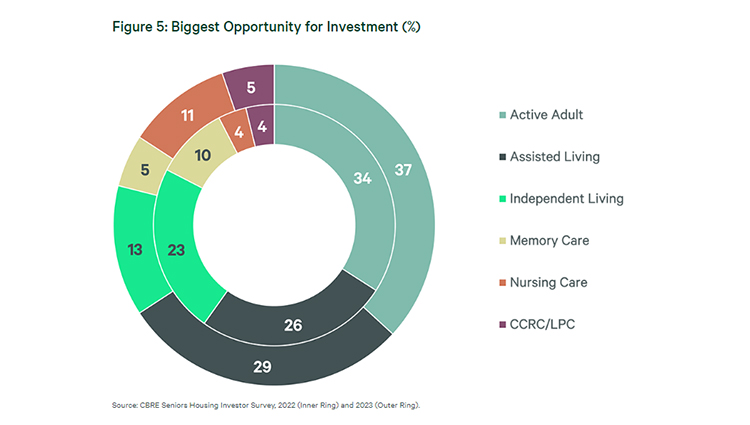

The U.S. Seniors Housing & Care Investor Survey 2023 pinpointed Active Adult communities as the “top investor category,” and it put up an average cap rate that increased by 21 basis points year-over-year.

The only category that had a decrease in its cap rate (by 34 basis points) was Skilled Nursing.

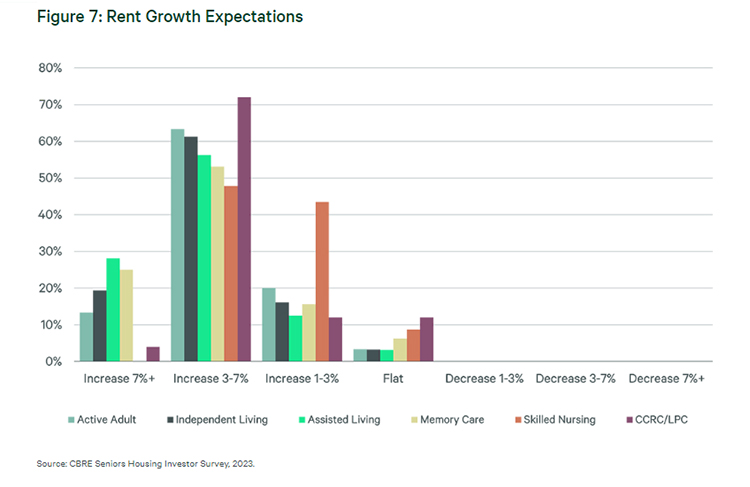

Average cap rates for Independent Living, Assisted Living and Memory Care facilities were up 28 basis points year-over-year. For Active Adult, Independent Living, Assisted Living and Memory Care facilities, the greatest percentage of respondents reported underwriting rental rate increases of 3% to 7% over the past year.

Continuing care retirement communities were up 38 basis points.

However, there were notable differences between Class A and Class C assets, with, for example, cap rates increasing 57 basis points for Core Class A Active Adult to 5.2% from 4.6% and decreasing 24 basis points for Core Class C Active Adult to 6.6% from 6.8%.

Nearly 50% of respondents said they expect cap rates will increase in 2023, a major jump from 27% last year.

More than 75% of respondents expected rental rates to increase 3% or more over the next year across all classes with the exception of Skilled Nursing, and no rental decreases were predicted.

For the industry as a whole, respondents cited as challenges higher borrowing costs, constrained lending and low staffing levels.