Construction Spending Up 0.2% Amid Growing Headwinds

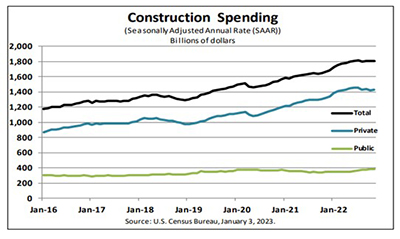

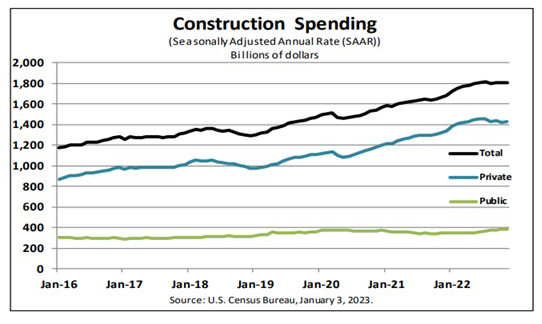

The Census Bureau on Tuesday reported construction spending in November rose to a seasonally adjusted annual rate of $1,807.5 billion, 0.2 percent higher than the revised October estimate of $1,803.2 billion and 8.5 percent higher than a year ago.

The report noted during the first 11 months of 2022, construction spending rose to $1,657.6 billion, 10.5 percent higher than the $1,499.8 billion for the same period in 2021.

Spending on private construction rose to a seasonally adjusted annual rate of $1,426.4 billion, 0.3 percent higher than the revised October estimate of $1,421.6 billion. Residential construction fell to a seasonally adjusted annual rate of $868.0 billion in November, 0.5 percent lower than the revised October estimate of $872.4 billion. Nonresidential construction rose to a seasonally adjusted annual rate of $558.3 billion in November, 1.7 percent higher than the revised October estimate of $549.2 billion.

The estimated seasonally adjusted annual rate of public construction spending fell to $381.1 billion in November, 0.1 percent lower than the revised October estimate of $381.6 billion. Educational construction rose to a seasonally adjusted annual rate of $81.3 billion, 0.1 percent higher than the revised October estimate of $81.2 billion. Highway construction fell to a seasonally adjusted annual rate of $115.0 billion, 1.0 percent lower than the revised October estimate of $116.2 billion.

Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C., said despite November’s improvement, headwinds are intensifying for the construction industry. “A broad-based decline in building permits recently suggests that residential construction will continue to retreat in coming months,” he said.

Dougherty said signs point to a weakening in nonresidential activity amid rising financing costs in the years ahead. “The Architecture Billings Index waned for the second straight month in November, falling to 46.6 from 47.7,” he said. “Although the volume of new contracts ticked up slightly, the value of new design contracts continues to fall as softening business conditions have led some firms to place larger projects on hold. Billings fell in the West, Midwest and Northeast while billings in the South ticked up slightly.”

Despite the downturn in billings, Dougherty said, the same survey found architecture firms are largely optimistic about 2023, with 63% of respondents expressing a positive outlook for the year.