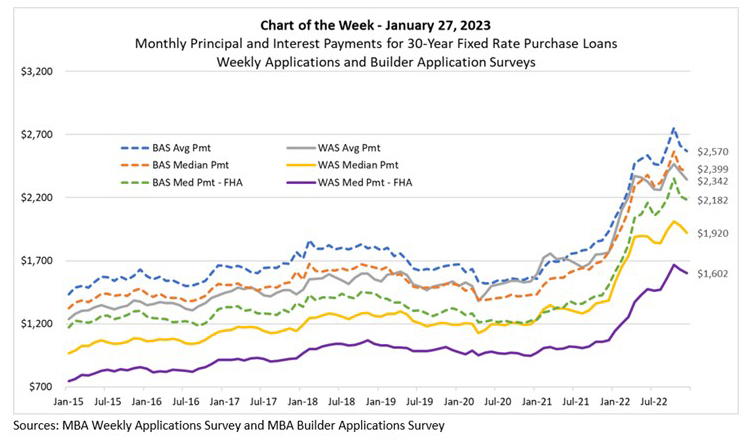

MBA Chart of the Week, Jan. 27, 2023: Monthly Principal, Interest Payments

In Thursday’s MBA Purchase Applications Payment Index (PAPI) release, MBA Research introduced a new measure—The Builders’ Purchase Applications Payment Index (BPAPI). While PAPI uses MBA’s Weekly Applications Survey purchase data to calculate mortgage payments, BPAPI uses analogous MBA Builder Applications Survey data to create an index that measures how new mortgage payments vary across time relative to income, with a focus exclusively on newly built single-family homes.

In this week’s MBA Chart of the Week, we track 30-year fixed rate principal and interest payments for both WAS and BAS purchase loans since 2015. In December 2021 the median payment in the BAS was $1,770 (orange dashed line). This figure jumped 35.5% to $2,399 in December—indicating starkly eroded affordability over 2022 for newly built single-family homes. Similarly, the WAS median payment (yellow line) increased by 38.8% over the same period to $1,920 in December.

The chart also shows average application payment amounts. In December, the amounts were $2,570 and $2,342 for the BAS and WAS respectively (blue dashed and solid gray lines). The average in the weekly survey was 22% higher than the median in the weekly survey in December. In other words, WAS loan amounts were skewed—with high balance loan applications pushing the average amount to $365,963 versus a median application of $300,000 in December. The BAS was also skewed, although the average was 7% higher than the median in December 2022 (versus 22% for the WAS).

The final series shows the median payments for FHA loans. The BAS median was $2,182 in December, or $580 more than the WAS median payment of $1,602.

MBA is forecasting a recession for the first half of 2023, as the full impact of the Fed’s rate hikes is absorbed throughout the economy. As such, we are forecasting that mortgage rates will come down to 5.2% in 2023 Q4. We are also forecasting that the median price for existing homes will be flat in 2023 (at approximately $375,000) and it will fall by 6.5% (to $440,600) for new homes. Together, these should help alleviate some of the affordability erosion we experienced in 2022.

–Edward Seiler eseiler@mba.org; Joel Kan jkan@mba.org; Ahn Doan adoan@mba.org.