ATTOM: Home Affordability Remains Hurdle in Q4

(Image courtesy of ATTOM; breakout image courtesy of Erik Mclean/pexels.com)

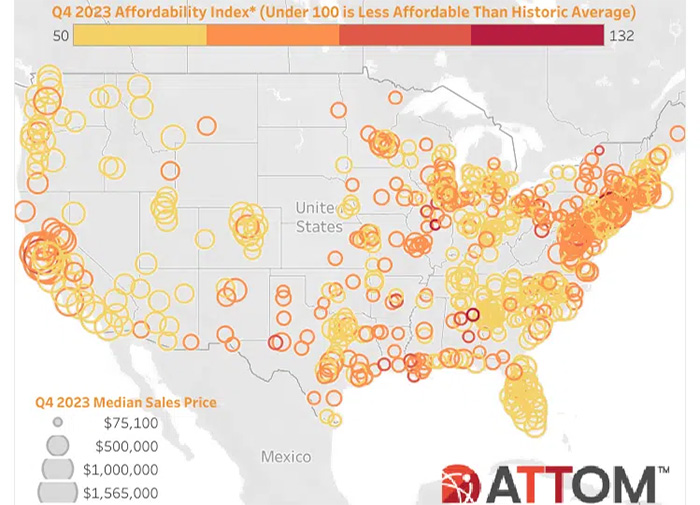

ATTOM, Irvine, Calif., found in its fourth-quarter 2023 U.S. Home Affordability Report that median-priced single-family homes and condos remain less affordable compared with historical averages in 99% of counties in the nation it analyzed.

It showed that major expenses on median-priced homes consume 33.7% of the average national wage of $71,708–well above what’s considered “affordable” by common lending standards. That’s up 3 percentage points from a year ago and 12 points from early 2021.

The typical monthly cost of mortgage payments, homeowner and/or mortgage insurance and property taxes nationwide stands at $2,016, but is flat from the third quarter.

“The good news is that home affordability has stopped getting tougher around the U.S., at least for the moment. The bad news is that owning a home remains more of a financial stretch than it’s been for many years,” said Rob Barber, CEO for ATTOM. “The annual fall slowdown in the housing market clearly has helped stem the tide working against potential purchasers. Whether that’s just a temporary thing tied to seasonal market patterns is something we won’t know until next year, especially given recent signs that interest rates are coming down. But for now, there is some break into the growing financial stress for house hunters.”

The portion of average local wages consumed by major home-ownership expenses on a typical home is considered unaffordable in more than 75% of the 580 analyzed counties.

Median home ownership costs in 572 out of the 580 analyzed counties are less affordable than in the past–flat from the third quarter and up slightly from Q4 2022. But, it’s almost double the number from Q4 2021.

The national median price for a single-family home has decreased from $344,670 in Q3 to $335,000 in Q4, ATTOM noted. But, that’s still 6% over Q4 2022.