2022 Foreclosures Double; Remain Below Pre-Pandemic Levels

ATTOM, Irvine, Calif., said 2022 foreclosure filings more than doubled from 2021 but remained well below pre-pandemic rates.

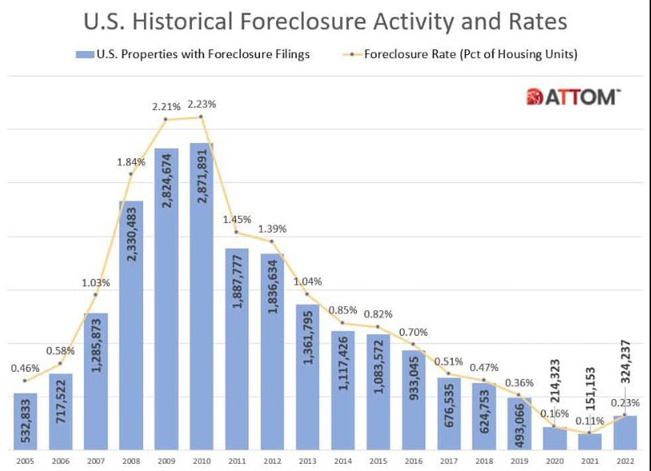

The company’s Year-End 2022 U.S. Foreclosure Market Report showed foreclosure filings on 324,237 U.S. properties, up 115 percent from 2021 but down 34 percent from 2019, before the pandemic shook up the market. Foreclosure filings in 2022 were also down 89 percent from a peak of nearly 2.9 million in 2010.

Properties with foreclosure filings in 2022 represented 0.23 percent of all U.S. housing units, up slightly from 0.11 percent in 2021, but down from 0.36 percent in 2019 and down from a peak of 2.23 percent in 2010.

“Eighteen months after the end of the government’s foreclosure moratorium, and with less than 5 percent of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.”

The report also noted for December 2022, 30,822, properties had foreclosure filings, up by less than 1 percent from the previous month but up by 72 percent from a year ago.

Key report findings:

–Lenders repossessed 42,854 properties through foreclosures in 2022, up 67 percent from 2021 but down 70 percent from 2019 (143,955) and down 96 percent from a peak of 1,050,500 in 2010.

–States that saw the greatest number of REOs in 2022 included Illinois (5,518); Michigan (3,669); Pennsylvania (2,741); New York (2,405); and California (2,223).

Metros with a population greater than 1 million that saw the greatest number of REOs in 2022 included Chicago (3,545); Detroit (2,135); New York (1,656); St. Louis (1,395); and Philadelphia (1,302).

“Unlike foreclosure activity during the Great Recession, the majority of homes in foreclosure are not being repossessed by lenders,” Sharga noted. “Our recent homeowner equity report shows that 93 percent of borrowers in foreclosure today have positive equity, which they appear to be leveraging in order to avoid a foreclosure by refinancing their mortgage or selling the property at a profit. It seems likely that this is a trend that will continue in 2023.”

–Lenders started the foreclosure process on 248,170 properties in 2022, up 169 percent from 2021 but down 26 percent form 2019 and down 88 percent from a peak of 2,139,005 in 2009.

–States with the highest foreclosure rates in 2022 were Illinois (0.49 percent); New Jersey (0.45 percent); Delaware (0.40 percent); Ohio (0.38 percent); and South Carolina (0.37 percent).

–Among 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in 2022 were Cleveland (0.70 percent); Jacksonville, N.C. (0.58 percent); Atlantic City, N.J. (0.58 percent); Columbia, S.C. (0.55 percent); and Chicago (0.53 percent).

–Properties foreclosed in the fourth quarter had been in the foreclosure process an average of 852 days, a 4 percent decrease from the previous quarter and 9 percent decrease from a year ago.

–States with the longest average time to foreclose in the fourth quarter were Hawaii (2,546 days); New Jersey (2,041 days); Louisiana (1,925 days); New York (1,828 days); and Pennsylvania (1,692 days).