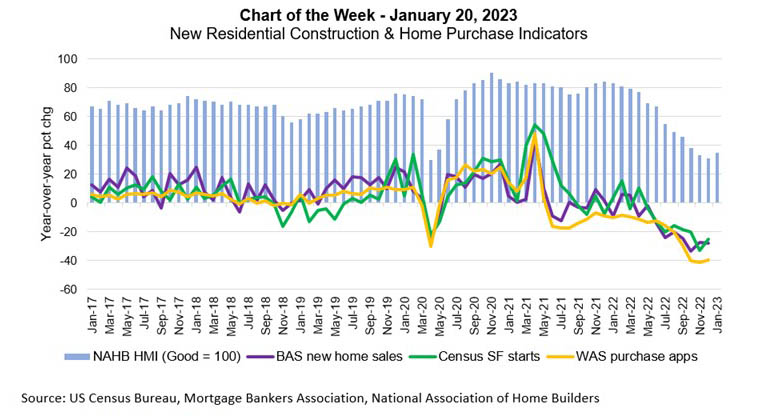

MBA Chart of the Week Jan. 20 2023: New Residential Construction/Home Purchases

This week’s MBA Chart of the Week captures data on new residential construction market and the state of new single-family home sales. Data on home sales, housing starts, and purchase applications are shown as year-over-year percent changes, while the National Association of Home Builders’ Housing Market Index is an index level.

December results from MBA’s Builder Applications Survey showed that new home purchase activity – both for applications and estimated new home sales – ran more than 20 percent behind last year’s pace. The decline in purchase activity was consistent with annual declines in single-family housing starts for much of the past year, as shown by the U.S. Census Bureau data for December. Higher mortgage rates contributed to already challenging affordability conditions, and fears of a weakening economy dampened housing demand in 2022, which in turn drove a pull-back in new construction. Single-family housing starts decreased 32 and 36 percent for November and December compared to the corresponding months in 2021.

The January NAHB HMI, which measures home builder sentiment, reflected a potential turning point in the outlook for new construction after 12 months of deterioration. Increased buyer traffic as mortgage rates have backed off from recent highs drove some of the improvement. A shortage of entry-level homes will continue to be a challenge, especially as demographic trends point to a market which will be more reliant on first-time homebuyers.

Many existing homeowners have significantly lower mortgage rates than currently available in the market now and are going to be less likely to move and list their homes.

MBA’s Weekly Applications Survey data on purchase mortgage applications, which includes both new and existing purchases, jumped last week, but are still about 35 percent below last year’s levels.

The coming months will be a challenge for the housing market, but we may have reached the trough. With mortgage rates expected to fall back below 6-percent this year, we expect both new residential construction and purchases to turn back up later this year.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.