Existing Home Sales Down 12th Straight Month

Existing home sales fell for the 12th straight month in January, the National Association of Realtors reported Tuesday.

Month-over-month sales were mixed among the four major U.S. regions, as the South and West registered increases while the East and Midwest experienced declines, NAR said. All regions recorded year-over-year declines.

“Although January’s drop came in contrast to expectations for a 2.0% rebound, it was the mildest drop since sales first started waning in February 2022,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Lower mortgage rates benefited buyers in January, likely staving off deeper declines.”

“Home sales are bottoming out,” said NAR Chief Economist Lawrence Yun. “Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines.”

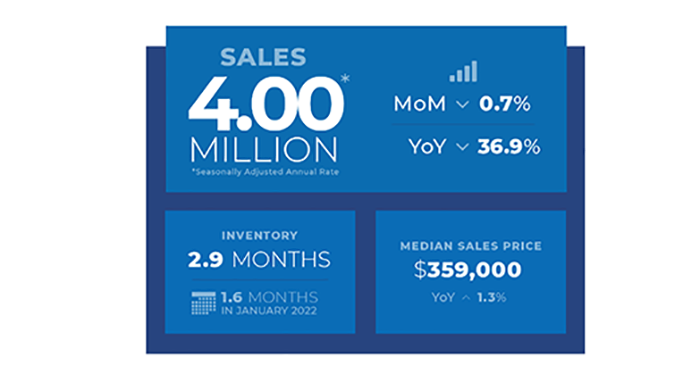

The report said total existing home sales slid by 0.7% from December to a seasonally adjusted annual rate of 4.00 million in January. Year-over-year, sales fell by 36.9%, down from 6.34 million in January 2022.

NAR reported total housing inventory at the end of January totaled 980,000 units, up 2.1% from December and 15.3% from one year ago. Unsold inventory sits at a 2.9-month supply at the current sales pace, unchanged from December but up from 1.6 months in January 2022.

“Inventory remains low, but buyers are beginning to have better negotiating power,” Yun said. “Homes sitting on the market for more than 60 days can be purchased for around 10% less than the original list price.”

The median existing-home price for all housing types in January rose to $359,000 up 1.3% from January 2022 as prices climbed in three out of four U.S. regions, falling only in the West. This marks 131 consecutive months of year-over-year increases, the longest-running streak on record, NAR said.

Properties typically remained on the market for 33 days, up from 26 days in December and 19 days in January 2022. NAR noted 54% of homes that sold in January had been on the market for less than a month. All-cash sales accounted for 29% of transactions in January, up from 28% in December and 27% in January 2022, the report said. Distressed sales–foreclosures and short sales–represented 1% of sales in January, identical to last month and one year ago.