January Jobs Report Smashes Expectations

The labor market defied expectations of even the most skeptical forecasts in January, adding a remarkable 517,000 jobs, the Bureau of Labor Statistics reported Friday.

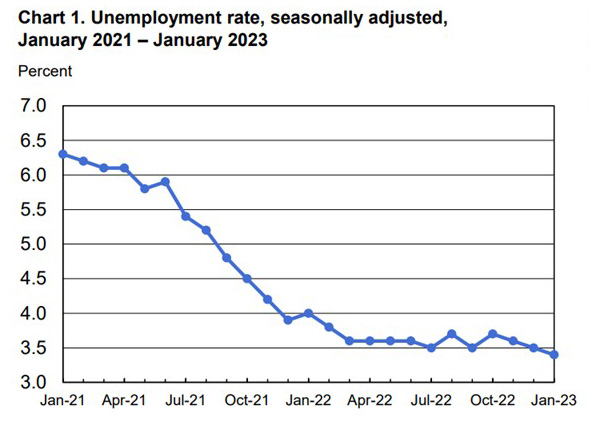

Analysts expected a more modest 185,000 January jobs and for the unemployment rate to increase to 3.6 percent. Instead, employers added more than double of projected jobs and the unemployment rate fell to 3.4 percent, the lowest rate since 1969.

BLS said job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike in the California education system.

The number of unemployed persons, at 5.7 million, changed little in January. BLS said the unemployment rate has shown little net movement since early 2022. The change in total nonfarm payroll employment for November revised up by 34,000, from +256,000 to +290,000, while the change for December revised up by 37,000, from +223,000 to +260,000.

Both the labor force participation rate, at 62.4 percent, and the employment-population ratio, at 60.2 percent, were unchanged. These measures have shown little net change since early 2022 and remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

“The pace of job growth had been trending down over the past six months, but January broke that trend,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Recent data on unemployment insurance claims have indicated a stronger job market than the string of layoff announcements from the technology and financial sectors would suggest. Job growth of 517,000 in January, and a drop in the unemployment rate to 3.4%, puts an exclamation point on the divergence between measures of economic activity and job market statistics.”

Fratantoni noted much of the job growth concentrated in sectors such as leisure and hospitality, which have struggled to fill job openings for much of the past year. “The decline in wage growth to 4.4% may be reflecting some of this shift to sectors that typically are lower wage,” he said. “However, slower wage growth in the service sector is the trend that Federal Reserve officials have been seeking, despite the persistent strength in the job market.”

Fratantoni added with the job market this tight, the Federal Reserve and financial markets will remain even more focused on the inflation data. “We expect another 25-basis-point increase in the federal funds target in March, but do anticipate that the unemployment rate, which does tend to be a lagging indicator, will increase through the course of the year,” he said.

“Further reduction in wage growth is the key to getting the Fed to pause its interest rate hikes,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “There is hope that, as consumers pull back on spending, more wages will continue to decelerate.”

“The unusually few layoffs that translated into such a strong headline gain is indicative of what remains an incredibly strong jobs market, and other details of today’s report underscored this strength,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Benchmark revisions increased the level of employment over the past couple years and showed stronger hiring momentum heading into 2023.”

House said Fed officials should remain cautious in reading too much into the magnitude of January’s payroll gain, “but the firm pace of average hourly earnings growth and a 53-year low in the unemployment rate should keep a 25 bps rate hike at the March 22 FOMC as the base case and another possible increase in May in play.”

The report said average hourly earnings for all employees on private nonfarm payrolls in January rose by 10 cents, or 0.3 percent, to $33.03. Over the past 12 months, average hourly earnings increased by 4.4 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 7 cents, or 0.2 percent, to $28.26.

The average workweek for all employees on private nonfarm payrolls rose by 0.3 hour to 34.7 hours in January. In manufacturing, the average workweek increased by 0.4 hour to 40.5 hours, while overtime increased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.2 hour to 34.1 hours.