Buyers Getting More for Money as Spring Season Approaches

Home buyers’ mortgage payments have started stretching a bit further, reported Zillow, Seattle.

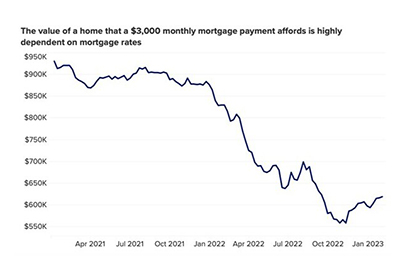

As mortgage rates doubled last year, the home price afforded by a $3,000 payment plummeted from $865,000 in January to just $560,000 in October. That significantly changed the size and price of homes within a buyer’s reach. Today, a $3,000 monthly mortgage payment buys a home 140 square feet smaller than a home purchased a year ago.

But as rates have dropped from a peak just above 7%, buyers are getting larger homes with higher price tags at a fixed monthly cost. The typical home value associated with a $3,000 mortgage payment is up about $60,000 since October and home size has recovered by 84 square feet, Zillow said in an analysis.

“Mortgage rates have a huge impact on the types of homes buyers are able to afford,” said Anushna Prakash, Economic Data Analyst with Zillow. “Rates that doubled over the past year carved an extra bedroom or office space off of homes at the national level, though the sting has lessened in recent weeks.”

Prakash noted buyers in more affordable hot markets are still getting solid bang for their buck, despite losing a lot of purchasing power.

The annual decline stands out in some markets more than others. Hartford, Conn., saw the largest drop in what $3,000 per month can buy in 2022, losing 1,200 square feet. Buyers in Indianapolis and Cleveland both lost out on more than 1,000 square feet in the last year. Cleveland and Kansas City are among the top 10 metros for home size at this price point and are among Zillow’s 10 hottest markets for 2023.

Homes in less expensive markets have a larger footprint to begin with, and therefore had farther to fall as climbing mortgage rates applied pressure to buyers’ wallets. “As costs rose in 2022, there were more buyers competing in those markets than in their more expensive counterparts,” the report said.

On the other hand, $3,000 per month has always gotten a buyer less space in pricey markets, but their floor plans are shrinking, too. In San Jose that payment will buy a 1,052-square-foot home, down from 1,268 square feet last year. Los Angeles, San Diego and San Francisco are close behind, with square footage for each below 1,400 square feet, Zillow reported.

Affordability remains a major challenge, but buying power for home shoppers has rebounded in recent months. Since bottoming out in October, home size for a $3,000 payment has increased the most in Salt Lake City (365 square feet), Minneapolis (357), Memphis (346) and Denver (340).

“Heading into the home shopping season, shoppers should prepare by improving their credit as much as possible in order to score the best mortgage rate,” the report said. “Even a small rate drop can save tens of thousands of dollars over the life of a loan.” For example, a borrower with a credit score between 760 and 850 can qualify for a 30-year fixed-rate mortgage with a 6.0% interest rate. For the same loan, a similar borrower with a score between 620 and 639 qualifies for a 7.58% rate. This equates to a $348 difference in monthly mortgage payments and nearly $125,431 in interest over the life of a 30-year fixed loan, based on the current price of a typical U.S. home ($329,542).