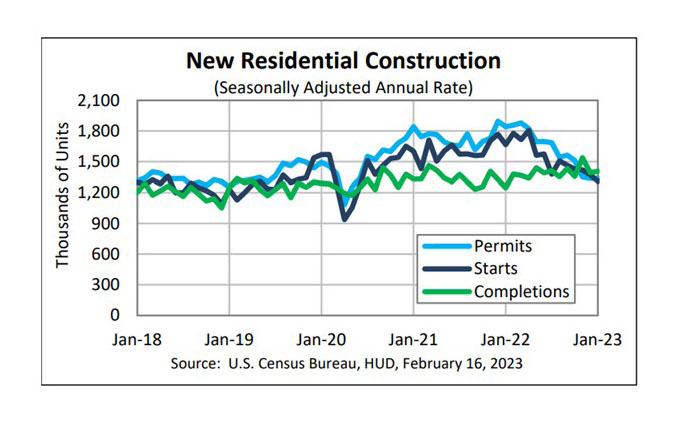

Housing Starts Down 5th Straight Month

Housing starts fell in January, HUD and the Census Bureau reported Thursday, marking the fifth straight monthly drop, the longest streak of declines since 2009.

The report said privately owned housing starts in January fell to a seasonally adjusted annual rate of 1,309,000, 4.5 percent lower than the revised December estimate of 1,371,000 and 21.4 percent lower than a year ago (1,666,000). Single‐family housing starts in January fell to 841,000, 4.3 percent below the revised December figure of 879,000. The January rate for units in buildings with five units or more fell to 457,000, down by 5.4 percent from December and by 8.4 percent from a year ago.

Regionally, results were quite mixed. Starts in the South rose by 7.3 percent to 760,000 units in January, seasonally annually adjusted, from 708,000 units in December, but fell by 17.3 percent from a year ago. In the West, starts rose by 5.5 percent to 307,000 units in January from 291,000 units in December but fell by 31.2 percent from a year ago.

In the Northeast, starts plunged by 42.2 percent to 119,000 units in January from 206,000 units in December but improved by 13.3 percent from a year ago. And in the Midwest, starts fell by nearly 26 percent to 123,000 units in January from 166,000 units in December and fell by 37.2 percent from a year ago.

“U.S. housing starts come in below consensus expectations,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “There remains a large backlog of single-family homes under construction, as builders have been hampered by supply-side headwinds from labor shortages and high construction material costs. Those homes are not move-in ready and thus do not meaningfully contribute to the stock of livable homes.”

Kushi said builders still face a difficult market as affordability challenges and supply-side headwinds persist. While mortgage rates have trended down over the last three months thanks to favorable inflation data, rates increased recently due to market expectations that inflation will persist, thereby requiring the Federal Reserve to remain restrictive for longer,” she said. “Even so, builders are hoping that we’re past the mortgage rate peak and can look for some mortgage rate stability in the months to come.”

“From today’s report, it is clear that elevated interest rates continue to weigh heavily on housing construction,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C.

“Though single-family starts have bounced around a bit in recent months, their trend remains one of general decline,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Combined with a steady decrease in new permits, this report is largely in line with our expectations for ongoing weakness in new home starts this year. Fundamentally, builders currently have a large inventory of new homes for sale that have already been completed or are under construction, so we expect builders will focus on completing and selling those previously started homes rather than beginning new projects.”

The report said privately owned housing units authorized by building permits in January rose to a seasonally adjusted annual rate of 1,339,000, 0.1 percent above the revised December rate of 1,337,000, but 27.3 percent below the January 2022 rate of 1,841,000. Single‐family authorizations in January fell to 718,000, 1.8 percent below the revised December figure of 731,000. Authorizations of units in buildings with five units or more rose to 563,000 in January, up by 0.5 percent from December but down by 4.1 percent from a year ago.

“Single-family permits declined 1.8%, marking the 11th straight month of deterioration,” Dougherty noted. “The ongoing slide in permits is an indication that builders continue to scale back plans for new single-family construction. Total permits inching higher was the result of a 2.5% gain in multi-family permits. The recent upshift suggest apartment and condo construction is likely to run at a strong pace, even as multifamily fundamentals begin to downshift.”

The report said privately owned housing completions in January rose to a seasonally adjusted annual rate of 1,406,000, 1.0 percent higher than the revised December estimate of 1,392,000 and 12.8 percent higher than a year ago (1,247,000). Single‐family housing completions in January rose to 1,040,000, 4.4 percent above the revised December rate of 996,000. The January rate for units in buildings with five units or more fell 349,000, down by 8.6 percent from December but up by 14.4 percent from a year ago.

“Single-family completions have outpaced housing starts since July 2022, and that will likely put some downward pressure on the numbers of single-family homes under construction in the months ahead,” Kushi said. “Builders will likely continue to focus on completing existing projects, rather than starting new ones. As new completed home inventory rises, it will provide some much-needed relief to a supply-starved market.”