Sponsored Content from CreditXpert–If Millennials Aren’t Buying Homes, Where Can Lenders Find Opportunity in this Market?

By Mike Darne

It’s common knowledge that Millennials are primed to be the next wave of homebuyers, stepping into their first homes, and laying down roots. However, a deep dive into macroeconomic data paints a very different picture. It’s evident that Millennials are not racing to pick up the keys to their new homes, and given their various daunting financial circumstances, it’s unlikely they will anytime soon. Should lenders and real estate agents still be targeting them and counting on them for their next sale?

In today’s mortgage market, predicting what will happen beyond 12 to 18 months is close to impossible — macroeconomic forces are at work more than anything else. So, why aren’t Millennials buying their first homes, if all the data points to them being next up in the homebuying cohort? Millennials are the largest group of potential home buyers in the country at this time: they are the right age, and according to historic data, they are the demographic that should be settling and buying homes. It’s just not happening, not yet. There’s a great deal of opportunity for the lending community to still get business, it may just not be where you’re currently looking.

Who Are the Millennials?

Millennials fall into the age range of 27-42, and many of them are currently in their prime homebuying years. Historically, those homebuying years have been within ages 30-34, but this rule doesn’t hold true for Millennials.

According to the National Association of Realtors, the average first-time home buyer was 33 years old in 2021. That year, 34% of all homes sold were to first-time buyers. By 2022, the typical buyer was 36 and only 26% of homes sold were to first-time buyers. We see the average age of homebuyers continuing this upward trend in the near future.

Potential Causes of Delayed Homebuying

The Affordability Crisis: CreditXpert’s own research done in 2023 found that 25% of surveyed Millennials are still living with family or friends. Rising mortgage rates and double-digit home price increases contribute to this hurdle. Millennials buying their first home are paying around 39% more than boomers did at the same age nearly 40 years ago.

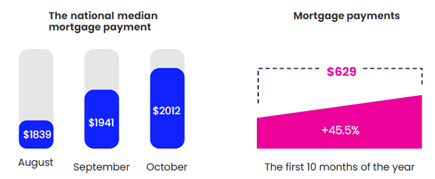

The national median monthly mortgage payment rose to $2,012 in October of this year, up from $1,941 in September and $1,839 in August. Monthly mortgage payments are up by $629 in the first 10 months of 2023, equal to a 45.5% increase.

Millennials Are Continuing to Pay for Their Education Instead of Buying Homes: Besides the skyrocketing home prices, there are many other sources of financial pressures millennials are burdened by today. The one most often cited is student loan debt. Over the years, we have observed that Millennials have been continuing to make payments on their education instead of buying homes. According to data collected by EducationalData.com, 35-year- olds have the highest average outstanding student loan debt at $42,600 per borrower; their typical end balance is 287% higher than the value of their original loan.

Consumers slightly younger, in the age group of 25-34, owe an average debt of $33,570. This has risen by 6.1% since 2017. Consumers slightly older, in the 35- 49-year-old group, owe an average federal debt of $43,208, which is up 17.9% since 2017.

The bulk of the outstanding student loan debt is held by the group aged 30 to 44 years old, who together owe 49% of the national student loan debt balance or $823 billion.

Millennials Are Nomads: Millennials like to move, travel and experience new places more than any other generation. It’s not hard to blame the pandemic for this as it severely limited the number of pivotal experiences this generation has enjoyed during such a critical phase in their lives. Many have embraced the urban lifestyle, and they may even prefer it over the suburbs, but they continue to rent because they can’t afford to buy. Millennials typically switch jobs more than other generations, so renting provides them with the ability to pick up and move on a whim.

Who Should Lenders Be Targeting?

The dominance of demographics on mortgage demand has diminished. Lenders can no longer default to that data point to forecast new loan demand.

That’s why we developed the Mortgage Credit Potential Index (MCPI). The MCPI is a monthly overview of credit inquiries that have been analyzed by CreditXpert’s predictive model. These inquiries represent all stages of the mortgage origination process, including inquiries made at the pre- qualification stage all the way through loan underwriting. The CreditXpert Platform enables lenders to assess an applicant’s credit potential and generate precise improvement plans that will help borrower’s qualify for better loan programs and lower the cost of homeownership.

The MCPI groups mortgage credit inquiries into 20-point bands starting with 300 and graduating to 850. For each 20-point band, the Index highlights the number (and percentage) of inquiries that could improve by at least one 20-point credit band by taking some relatively simple actions.

This allows lenders to see that there is opportunity all over the consumer credit spectrum, from the lowest credit bands to the highest. This means that lenders now aren’t limited solely to Millennials.

Our data suggests that there is a significant opportunity for 74% of loan applicants with scores below 780 to better their score by at least one 20-point band within 30 days, i.e. before the loan gets to the closing table.

Instead of spending your time chasing Millennials who will likely not be ready to buy a new home for several years, find out where the true growth potential lies by downloading the most recent Mortgage Credit Potential Index on our website today.

Click here to download our Why Aren’t Millennials Buying Homes Whitepaper >>.

(Sponsored content includes material submitted independently of the Mortgage Bankers Association and MBA NewsLink and does not connote an MBA endorsement of a specific company, product or service. For more information about sponsored content opportunities, contact Bill Farmakis at bill@jlfarmakis.com or 203/834-8832.)