Fannie Mae Survey: Experts See Home Prices Rising 2.4% in 2024

(Image courtesy of Fannie Mae; Breakout image courtesy of Binyamin Mellish/pexels.com)

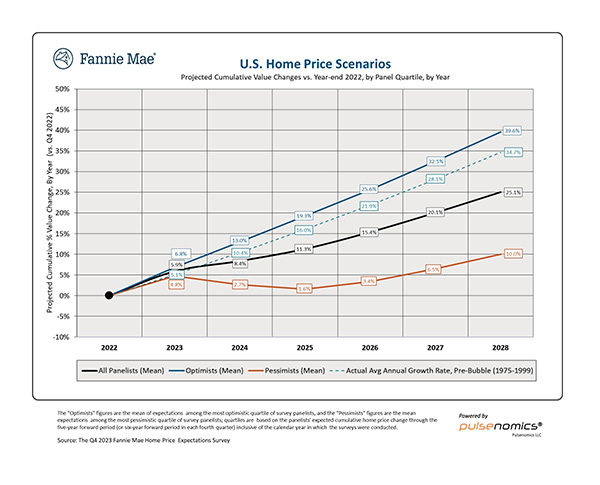

Fannie Mae’s quarterly Home Price Expectations Survey, produced in partnership with Pulsenomics, found experts anticipate home price growth to end up at 5.9% for 2023, with 2.4% predicted in 2024 and 2.7% in 2025.

The survey, of 100 experts in the housing and mortgage industries and academia, also asked about the outlook for the average 30-year fixed rate mortgage. The responses pegged it as settling at 5.7%.

“Looking beyond the recent volatility in mortgage rates, panelists expect future rates to decline meaningfully from the recent highs of 8%,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “This would obviously provide improved affordability for potential homebuyers, although anyone expecting the return of the extremely low rate environment from 2020 to 2022 will likely be disappointed. The panelists also revealed that they anticipate other factors will impact long-term interest rates, including demographic trends, expanding fiscal deficits, the evolution of artificial intelligence and the green energy transition.”

The survey also delved into special topic questions, including some related to a potential recession.

Of the respondents, a plurality of 38% believe the next recession will begin after 2024. Twenty-four percent believe it will be in the second quarter of 2024, and 19% answered in the first quarter of 2024.

A majority believe a recession would be short duration, mild intensity at 51%. The next highest response–average duration, mild intensity, was at 21%. Only 4% selected one of the “long duration” responses.