Arbor: Single-Family Rental Investment Sector Remains Strong

(Image via Arbor)

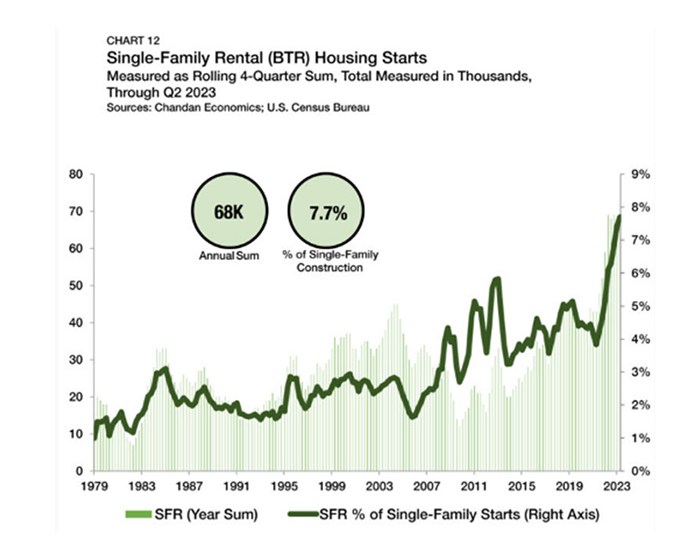

Arbor, Uniondale, N.Y., released its Single-Family Rental Investment Trends Report for the fourth quarter, highlighting a strong landscape for SFR/build-to-rent construction in the second quarter.

The category amounted to 7.7% of all single-family starts–a record for the sector. Many priced-out homebuyers are choosing build-to-rent communities, bolstering their growth, Arbor noted.

In terms of other SFR trends, rent growth for lease renewals continued to track above long-term averages. While rent growth has moderated somewhat, it remains well above pre-pandemic levels.

Prior to 2020, SFR renewal rent growth had never been above 5%, but it was above that level for 30 straight months through July 2023.

On-time rent payments remained at a good place, with an estimated 82.1% of units paying in full on time.

Cap rates were at 6.1% in the third quarter as home prices remain high, a slight drop from the recent trend line.

In the CMBS market, SFR issuance has improved somewhat, but remains subdued.

New acquisition loans are now the predominant purpose type for SFR originations. Per Fannie Mae, Arbor reported, new SFR loans intended for purchasing were 59.7% of originations to single-family investors in 2022, the majority for the first time since 2018.

That strength has continued into 2023–through the first half of the year, loans for acquisitions were 75.9% of single-family investor originations, a record.

Occupancy rates across all SFR property types averaged 94.4% in the third quarter, down 10 basis points from the previous quarter.

Through the second quarter, the average valuation of a single-family rental receiving a Fannie Mae mortgage fell slightly, to $330,972, down 6.7% from the 2022 average. This contrasts owner-occupied unit valuations, up 1.2% in the same time period. Arbor noted this is likely due to more selective investing.

Debt yields remained fairly flat during the third quarter of 2023, up by 3 basis points.

Overall, Arbor said, the SFR sector is well-positioned to limit distress through current economic conditions.