Zillow Predicts Improved Affordability, More Homes For Sale in 2024

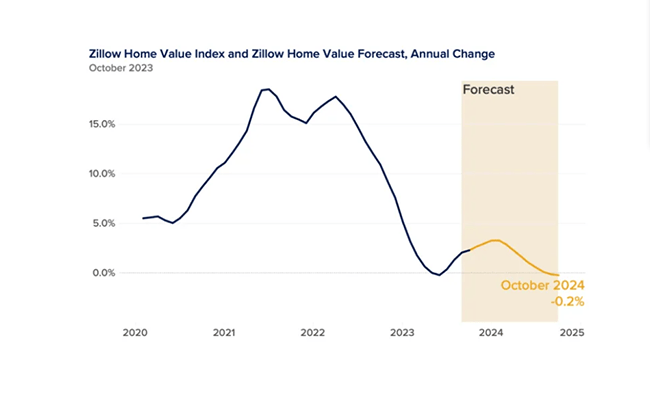

(Chart courtesy of Zillow)

Zillow, Seattle, predicts home buyers will have a bit more financial breathing room in 2024, although affordability remains a challenge.

“I expect the beginning of a long healing process to kick off in the housing market next year,” said Skylar Olsen, Zillow chief economist. “We know there are a huge number of households in prime home-buying ages waiting for the winds to turn in their favor. While still presenting challenges, the market will be better for buyers, with more homes to choose from and improved affordability.”

Olsen said many people will continue to look toward rentals and given renter demographics, single-family rental demand in particular will be strong. “Recent deliveries should keep rent growth down and concessions high in that market, too,” she said. “This is our breather year.”

It’s becoming clear that high mortgage rates have some staying power, and Zillow economists expect more homeowners who locked in long term payments when rates were near all-time lows to list their homes for sale as they grow weary of waiting for 2021’s historically low rates to return.

The cost of buying a home looks likely to level off next year, with the possibility of costs falling if mortgage rates do, Zillow said. That would give wages and buyers’ savings time to grow – a welcome change from the rapid rise of housing costs during the past two years.

Inventory has been far below normal for a while, and though Zillow economists predict more homes will hit the market in 2024, inventory will remain much lower than pre-pandemic norms. Faced with limited choices, traditional home buyers will compete with flippers for homes that need a little TLC or have small flaws such as an outdated kitchen or bathroom.

The higher cost of buying a home today makes a flip harder to do, so buyers may face less competition from flippers than they might have in previous years. While there may be less chance of being subject to a bidding war, these homes will still be expensive, so it’s expected that buyers will frequent their local hardware stores as they work on DIY home improvements.

Although Zillow predicts some improvement in home-buying affordability in 2024, many households will still be priced out. The median renter is now 41 years old, up from 37 years old in 2000, and the types of rentals they’re interested in has likely shifted.

Zillow expects prices – and demand – for single-family rentals will continue to increase next year as families search for more affordable options that allow them to enjoy amenities such as a private backyard or a home that doesn’t share walls with neighbors.

Many markets will also see rental demand surge near downtown centers, following New York City’s lead. Suburban rent prices were growing faster than rent in urban neighborhoods in the years prior to and during the pandemic, and the gap has narrowed some. Although suburban rents continue to outpace urban rents in most major markets, areas with longer commutes and farther from office-filled neighborhoods are seeing relatively less demand.

Renters looking near downtown will likely have more options with this year’s multifamily construction boom, which means a vast number of new homes have hit the market. More choices for renters means that landlords who are trying to attract tenants have more reason to compete with each other on price. This is a key reason that more rental listings are offering concessions.