Fannie Mae: Housing Sentiment Stuck in Low-Level Plateau

(Illustration courtesy of Fannie Mae)

Only 14% of consumers believe this is a good time to buy a home, a new Fannie Mae Survey found.

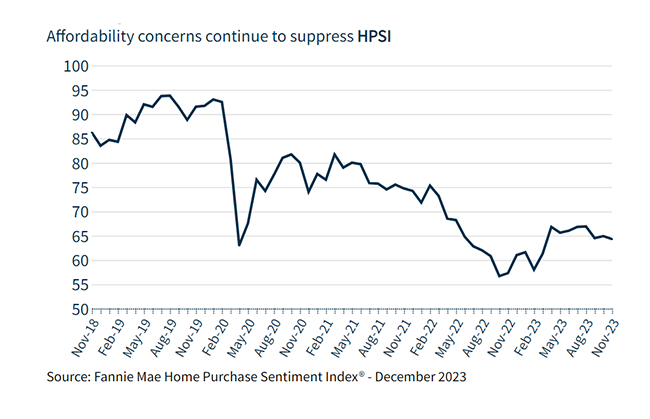

The Fannie Mae Home Purchase Sentiment Index decreased 0.6 points in November to 64.3, remaining within the bounds of the low-level plateau it established in the first half of 2023. “Consumers’ perceptions of homebuying conditions remain overwhelmingly pessimistic, as only 14% of consumers believe it’s a good time to buy a home, a new survey low,” the report said. “Pluralities of respondents also continue to expect both home prices and mortgage rates to increase over the next 12 months.”

Overall, the full index is up 7.0 points compared to a year ago.

“Over the past year, the HPSI has plateaued at a low level, evidence of persistent consumer pessimism regarding the state of the housing market,” Fannie Mae Senior Vice President and Chief Economist Doug Duncan said. “Looking back, consumer belief that it’s a ‘bad time to buy a home’ hit a survey high several times this year – including this month – and each time the pessimism could be attributed to high home prices and high mortgage rates.”

As mortgage rates approached 7% at the end of 2022–a rate level not seen in over a decade, a plurality of consumers said they expected home prices to decrease. “However, that optimism faded over the course of 2023,” Duncan said. “A significant majority of respondents have also continued to expect mortgage rates to increase or stay the same, though these expectations have tempered over the year. At the same time, consumers have expressed a reduced sense of financial security, with fewer respondents reporting household income growth over the year and a higher percentage saying their incomes remained the same.”

Duncan noted the combination of persistent affordability challenges and less rosy household finances remain the primary drivers of the low-level plateauing of housing sentiment. “Even if mortgage rates decline over the next year, which we currently expect, it’s unlikely to meaningfully affect affordability,” he said. “The lack of housing inventory is likely to remain a challenge for some time, and home purchase sentiment may continue to be suppressed as a result. As our forecast indicates, we believe it will be a couple years before homes sales return to more normal, pre-pandemic levels.”

The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 16% to 22%, while the percentage who expect mortgage rates to go up decreased from 47% to 44%, Fannie Mae reported. The share who think mortgage rates will stay the same decreased from 36% to 34%. “As a result, the net share of those who say mortgage rates will go down over the next 12 months increased 8 percentage points month over month,” the report said.