Zillow: Monthly Mortgage Costs on Typical Purchase Down 1.5% in November

(Image courtesy of Zillow; breakout image courtesy of Dominika Roseclay/pexels.com)

Zillow, Seattle, found in its latest market report that the monthly mortgage costs on a typical home purchase fell 1.5% from October to November–down from an October peak with costs up 9% annually and 120% over pre-pandemic rates.

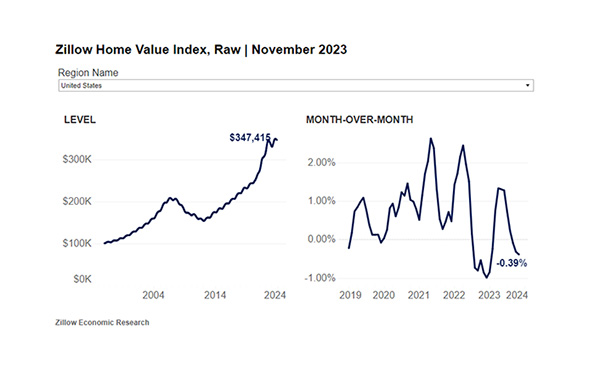

Falling mortgage rates propelled most of that decrease, but home values are also moderating, Zillow said. Its Home Value Index fell 0.4% from October to November.

However, the typical national home value is still up 2.8% annually, at $347,415.

“Despite high-cost headwinds, buyers have a few things to be thankful for in today’s market,” said Zillow Chief Economist Skylar Olsen. “Home prices are cooling down faster than normal as new listings from existing owners and total inventory slowly recover. Mortgage rates are still above 7%, but price cuts are surprisingly common, and mortgage costs eased a bit. These factors favor buyers who are reluctant to pause their home search in the off-season.”

New listings continue to show some improvement–now only down 14.1% from pre-pandemic norms. That’s a significant improvement over some past months–including April, when they were down by 34.8%.

While new listings were down by 20.5% month-over-month in November, they were just over 3% higher than last year.

Price cuts also materialized in November–at a rate Zillow said was unseasonably high. In November, 22.6% of listings had a price cut.

Homes that are selling are moving quickly–homes sold in the month went under contract in three weeks. That’s more than two weeks faster than pre-pandemic seasonal norms.

Asking rents fell slightly at a rate (0.2%) that Zillow pinpointed as seasonal. The typical U.S. rent is now $1,982. Rent is up 3.3% from last year, and has been stronger for single-family rentals than multiple-family.