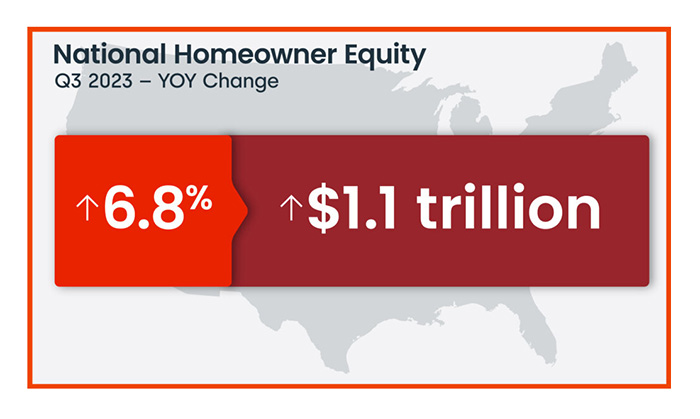

CoreLogic: Homeowner Equity Up 6.8%

(Image courtesy of CoreLogic)

CoreLogic, Irvine, Calif., found U.S. homeowners with mortgages’ equity has increased by $1.1 trillion since this time last year, a 6.8% gain year-over-year.

That’s a turnaround from the first two quarters of 2023, which saw slight annual losses.

In the third quarter of 2023, the average homeowner had gained approximately $20,000 in equity over the past year.

Steady increases in prices through the third quarter helped boost equity. Slow home sales activity also has resulted in fewer mortgage originations and improved the overall loan-to-value ratio.

The number of mortgaged homes with negative equity also decreased from the second to third quarter, by 7.7%. That’s equivalent to about 1 million homes, or 1.8% of all mortgaged properties.

Year-over-year the number of homes with negative equity dropped by 8%.

The national aggregate value of negative equity was $314.1 billion at the end of the third quarter, down quarter-over-quarter by 6.6%. It’s also down year-over-year by 2.4%.

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up,” said Selma Hepp, Chief Economist for CoreLogic. “These include Northeastern states such as Massachusetts, Rhode Island, Connecticut, New Hampshire and Maine, all of which posted about double the national gain.”

However, Hawaii, California and Massachusetts posted the largest national equity gains. Three states–New York, Texas and Utah–saw equity losses, along with Washington, D.C.