Yardi Matrix: 2024 Multifamily Outlook Mixed

(Image courtesy of Yardi Matrix)

Yardi Matrix, Santa Barbara, Calif., released an outlook for the multifamily market in 2024, pointing to expectations as “mixed.”

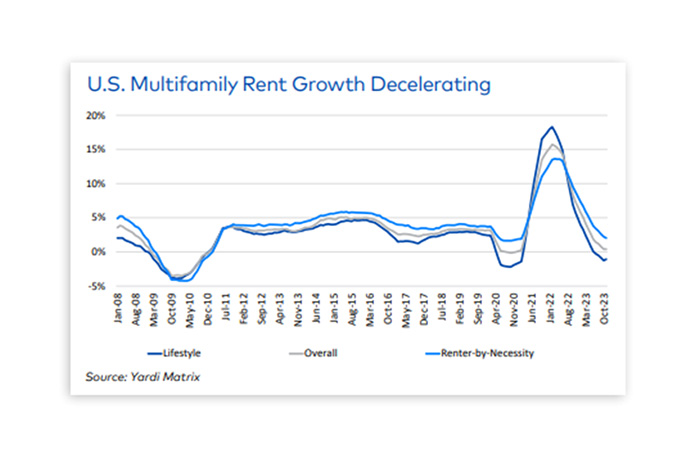

The outlook forecasted rent growth will be positive in 2024, but only at a modest 1.5% nationally. It will be moderated by factors such as slowing absorption, supply growth and declining affordability after the past few strong years.

For context: Rent growth rose a combined 23.5% nationally in 2021 and 2022. But year-over-year growth through November 2023 was down to 0.4%.

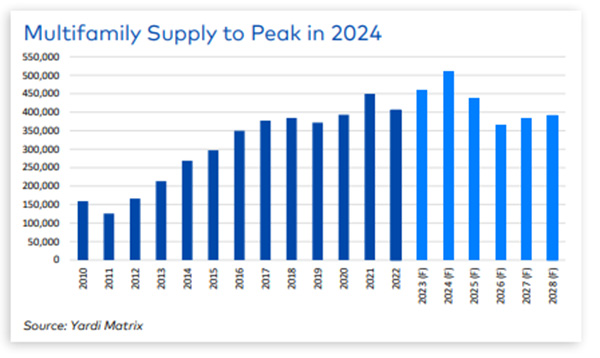

It anticipated that 2024 will be a peak year for deliveries. Supply growth remains strong–with more than 1.2 million units under construction and more than half a million deliveries anticipated next year.

But, rising costs for construction will continue to tamper that trend. Multifamily expenses are rising rapidly, including materials and labor costs, and insurance.

Capital markets have been hard-hit by rising interest rates, and Yardi Matrix anticipates a sluggish environment until likely mid-2024.

Ultimately, multifamily will face a number of challenges in 2024, Yardi Matrix analysts wrote.

“We are no longer in a rising-tide lifts-all-boats market. The traditional property acquisition pipeline will likely remain stalled through most of the year, so near-term opportunities will be concentrated in debt investments and providing capital for property restructurings,” the outlook stated. “The challenges are not insurmountable for owners with a long-term perspective, but they will take skill and expertise to navigate.”