Zillow: Home Buyers Gaining Breathing Room

(Chart courtesy of Zillow)

A warmer-than-normal housing market now shows signs of a typical late-summer seasonal cooldown, the latest Zillow market report said.

Competition is still strong, but buyers have a bit more time to find and consider their big purchase, the report said.

“The housing market is returning to normal seasonal patterns, and that’s a positive sign for buyers who faced stiff competition this spring,” Zillow Senior Economist Nicole Bachaud said. “As summer winds down and kids head back to school, home shopping gets put on the back burner. Traditionally, buyers who remain in the market gain a bit more bargaining power heading into the fall. This year, however, sellers are sticking to the sidelines, which means even fewer options and high prices.”

Zillow said the typical U.S. home value climbed 0.9% from June to July–a brisk pace for this time of year, but a step back from 1.4% growth in the two preceding months. The nation’s typical home value now exceeds $349,000 which is 1.4% higher than last July and 46% above pre-pandemic levels in February 2020.

Easing monthly appreciation is one sign that the normal seasonal pendulum of the market is swinging back in favor of buyers, Zillow noted. Homes are also spending longer on the market before going under contract — 12 days in July compared to 10 in April and May.

The volume of newly pending sales also slowed down along seasonal trend lines, falling about 6.5% from June to July, Zillow reported. Sales of existing homes, constrained by affordability challenges and a lack of homes on the market, are down about 15% year over year.

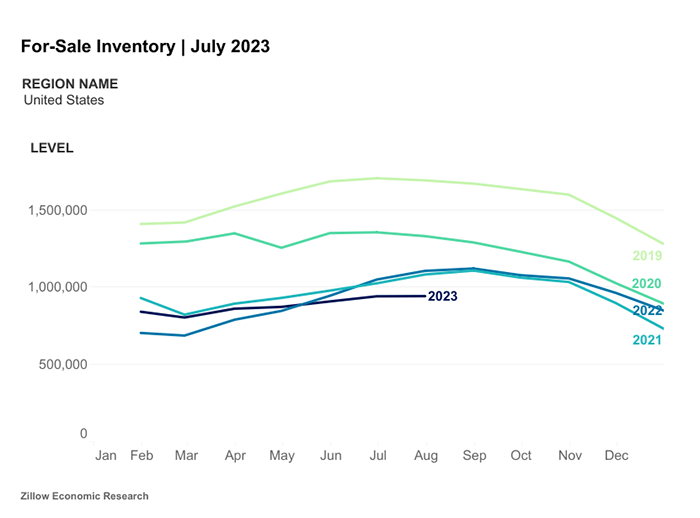

The number of listings with a price cut ticked up slightly from June as well. The share is right in line with pre-pandemic norms at about 22%. Total active inventory in July was down 15% from last year and a tremendous 44% below July 2019 levels.

“Buyers should not expect to see many more homes available for sale on Zillow at any time this year than they do now,” Bachaud said. “Inventory will decline from here if it follows pre-pandemic trends.”