First American: What Happens to Cap Rates if…

Xander Snyder is Senior Commercial Real Estate Economist with First American, Santa Ana, Calif.

Multifamily capitalization rates have now increased for three consecutive quarters, the first time since the Great Financial Crisis. This is a sign that investors are requiring higher yields today in order to purchase a property.

The three-quarter upward march of multifamily cap rates has been driven in large part by muted transaction volume, which is an indication of softening demand to own apartment properties. Multifamily transaction volume has declined following the frenzied pace during the pandemic, and even remains depressed relative to pre-pandemic levels. With lingering uncertainty around transaction volume trends and cloudy macro-economic conditions (recession or no recession?), it can be insightful to conduct a sensitivity, or “what if,” analysis.

A “What if” Analysis

Using First American’s Multifamily Potential Cap Rate (PCR) model, we can simulate what multifamily cap rates would be under various transaction volume scenarios. For example, we can answer the questions, “What if multifamily transaction volume fell to pre-pandemic levels? Then what would multifamily cap rates be?”

The multifamily PCR was 4.9 percent in the second quarter of 2023[1], up from 4.6 percent in the first quarter of 2023 due to lower multifamily transaction volume and slower renter household formation.

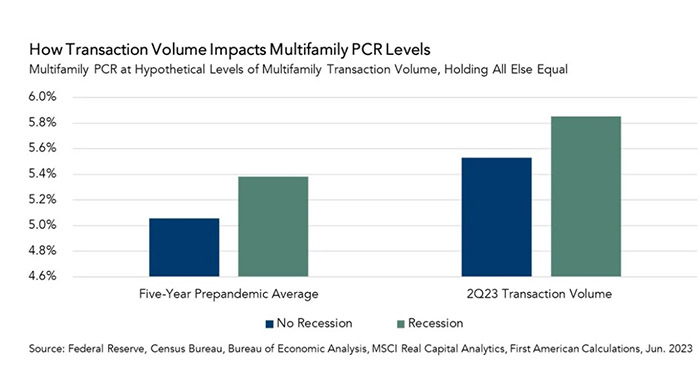

Holding all else equal, if multifamily transaction volume reverted to pre-pandemic levels and remained that way for several quarters, the multifamily PCR would be 5.1 percent. This increase compared to the current read is due in part to elevated multifamily transaction volumes over the last year compared with the pre-pandemic average. This scenario is if no recession occurs.

But a recession could impact multifamily cap rates in several ways, either through tighter credit, falling demand to lease apartments or a preference on the part of investors to choose less risky assets in times of uncertainty, all of which would impact apartment property prices. If a recession were to occur, the multifamily PCR would increase further to approximately 5.4 percent.

If, instead, multifamily transaction volumes persisted at the levels seen in the second quarter of 2023, which were 34 percent below the pre-pandemic average, and stayed that way for several quarters, the multifamily PCR would increase to 5.5 percent without a recession and approximately 5.9 percent with a recession.

The “So What” to the “What if”?

Depending on how transaction volumes trend and the macroeconomic environment, this sensitivity analysis suggests that the multifamily PCR could increase by another 100 basis points, compared with its current level of 4.9 percent, in a downside scenario. It also suggests that if transaction volume reverts to pre-pandemic levels and stabilizes, the multifamily PCR may only increase by about 20 additional basis points. No matter how you cut it, multifamily cap rates seem likely to rise further.

[1] The multifamily PCR uses the last twelve months of transaction data, as of the prior quarter. So, the 2Q23 multifamily PCR is using transaction volume data from 2Q22-1Q23, which was elevated compared with historical levels.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker at mtucker@mba.org or Editorial Manager Anneliese Mahoney at amahoney@mba.org.)