Pending Home Sales Increase Again

(Courtesy National Association of Realtors)

Pending home sales increased 0.9% in July–the second consecutive increase–the National Association of Realtors reported Wednesday.

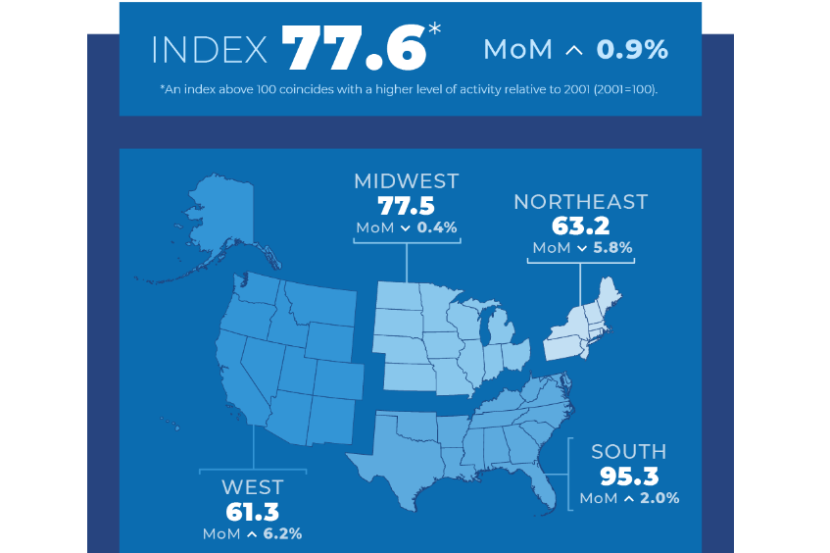

The Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, rose 0.9% to 77.6 in July. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.

On a year-over-year basis pending transactions fell by 14.0%. An index of 100 equals the level of contract activity seen in 2001.

Regionally, the Northeast and Midwest posted monthly losses, while sales in the South and West grew, NAR reported. All four U.S. regions saw year-over-year declines in transactions.

“The small gain in contract signings shows the potential for further increases in light of the fact that many people have lost out on multiple home buying offers,” said NAR Chief Economist Lawrence Yun. “Jobs are being added and, thereby, enlarging the pool of prospective home buyers. However, rising mortgage rates and limited inventory have temporarily hindered the possibility of buying for many.”

Mark Fleming, Chief Economist with First American, Santa Ana, Calif., called July a good month compared with August because mortgage rates were lower than they are now. “[But] we’re likely not out of the woods yet,” he said. “August data will likely be impacted. High mortgage rates are a double-edged sword: homeowners are further disincentivized to sell, buyers lose affordability.”

Fleming said according to First American’s analysis, the nation was in a housing recession between May and November last year. “We briefly came out of recession between December and April of this year, but have since dipped back in to housing recession this summer as rates have increased and sales volume dipped lower again,” he said.

Pending Home Sales Regional Breakdown

The Northeast PHSI shrank 5.8% from last month to 63.2, a decrease of 20.2% from July 2022. The Midwest index fell 0.4% to 77.5 in July, down 16.0% from one year ago.

The South PHSI lifted 2.0% to 95.3 in July, declining 10.9% from the prior year. The West index improved 6.2% in July to 61.3, dropping 12.8% from July 2022. “Interestingly, the West region experienced a meaningful price decline in the past year and buyers are quickly returning as a result,” Yun noted.