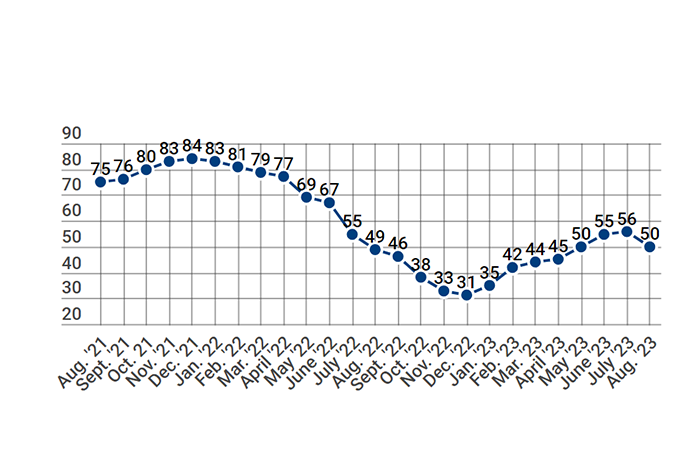

Builder Confidence Falls as Mortgage Rates Rise

(Chart courtesy NAHB/Wells Fargo)

Homebuilder confidence retreated in August as mortgage rates approached 7% and stubbornly high shelter inflation further eroded housing affordability, the National Association of Home Builders and Wells Fargo reported.

Builder confidence in the market for newly built single-family homes had steadily increased for seven consecutive months, but fell six points in August to 50, the NAHB/Wells Fargo Housing Market Index said.

NAHB Chief Economist Robert Dietz said declining customer traffic is a reminder of the larger challenge that shelter inflation is up 7.7% from a year ago and accounted for 90% of the July Consumer Price Index increase. “The best way to bring housing inflation down and ease the housing affordability crisis is to enact policies at all levels of government that will allow builders to construct more homes to address a nationwide shortfall of approximately 1.5 million housing units,” he said.

The August HMI survey revealed that rising mortgage rates are causing more builders to use sales incentives to attract home buyers. After dropping steadily for four months (from 31% in March to 22% in July), the share of builders cutting prices to bolster sales rose again to 25% in August, the report said. The average decline for builders reducing prices remained at 6%. And the share of builders using incentives to bolster sales was 55% in August, higher than in July (52%) but still lower than in December 2022 (62%).

The NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor. All three major HMI indices posted declines in August.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased four points to 56, the Midwest and South were both unchanged at 45 and 58, respectively, and the West edged down a single point to 50.