Home Investor Share Remains High, CoreLogic Finds

(Image courtesy CoreLogic)

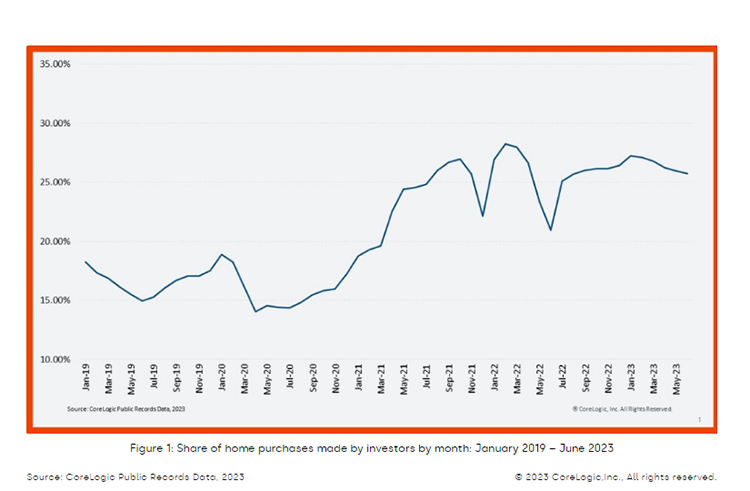

CoreLogic, Irvine, Calif., reported the U.S. home investor share remained high throughout the early summer, with 26% of all single-family home purchases in June.

Per Corelogic’s data, 2021 saw a surge in investor activity that has largely held. While it has declined slightly, there’s no sign the share will fall back to pre-pandemic rates soon.

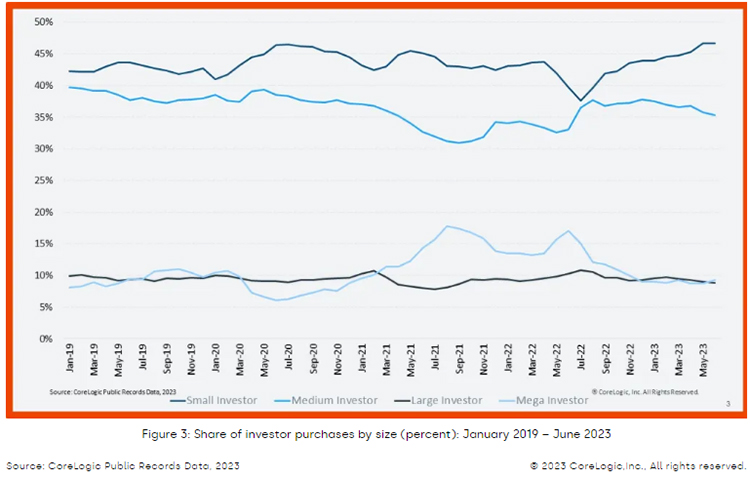

Mega-investors (with 1,000 or more properties) and large investors (100-999 properties) have held market shares between 8-10% throughout 2023. That’s a large drop from a high of 17% of all investor purchases from those groups in June 2022. Medium investors (10-99 properties) dropped from 37% to 35%.

CoreLogic noted that housing market investors are becoming more likely to be small (three to nine properties) with 47% of all investor purchases in June. That’s the highest level since 2011.

Home investor shares were highest in California (34%), Washington, D.C., (33%), Georgia (32%), New Mexico (31%), Texas (31%), Nevada (30%), Utah (29%), Arizona (29%) and Kansas (29%).

Data also points to a continued slowdown in house-flipping, as only 12% of investors who purchased a home in December 2022 had resold it by the end of June. That’s a lower number than in previous years, but slightly up from 11% three months earlier.

There was a slight uptick in iBuyer purchases in the past few months, which provides evidence that the flipping rate could rise again.