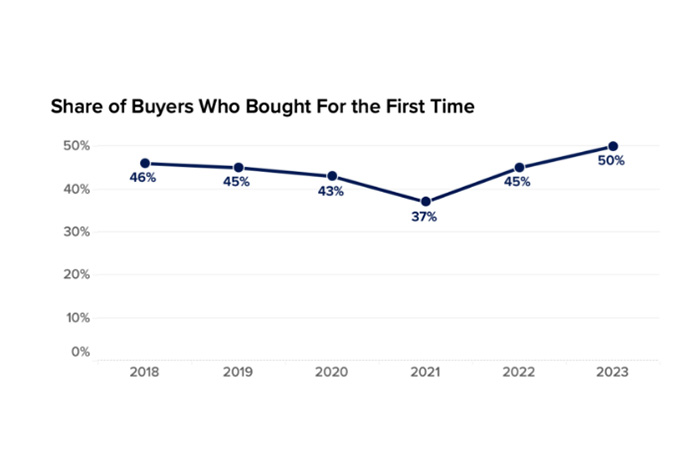

Zillow: First-Time Home Buying Jumps to 50%

(Image courtesy Zillow)

Zillow, Seattle, found in its 2023 Consumer Housing Trends Report that first-time buyers now make up 50% of all buyers, up from 45% in 2022 and 37% in 2021.

Zillow noted that this gain comes amid a market in which many homeowners are unwilling to sell due to high rates. But, the rise in first-time buyers is also helping drive demand and keep upward pressure on prices.

“High mortgage rates and a shortage of inventory is keeping would-be repeat buyers in their current homes,” said Zillow Senior Population Scientist Manny Garcia. “A greater relative share of first-time buyers is filling the gap, and they’re competing against each other for the limited number of affordable starter homes on the market.”

The last time first-time buyers made up this significant of a share was in 2010, when there was an applicable tax credit.

Nearly half of first-time buyers are millennials, and Gen Z is making up about 27% of all first-time buyers. The median U.S. buyer is 40, partnered or married, has at least some college education and is most likely to buy a home in the South.

Most buyers purchased single-family homes, at 77%. Seven percent of purchases were townhouses or rowhouses, 7% were condos, 6% were manufactured homes, 3% were duplexes or triplexes and 1% were other dwellings.

Zillow highlighted the increase in pricing pressures, as it now takes typical first-time buyers nearly 12 years to save up for a down payment–that number was nine years pre-pandemic. First-time buyers largely report utilizing at least two sources to finance downpayments, such as a combination of savings and gifts.

In order to gain a comprehensive understanding of U.S. buyers, Zillow Group Population Science conducted a nationally representative survey of more than 6,500 buyers. The study was fielded between April and July 2023