Auction.com: Default Servicers Expect Slight Increase in Foreclosure Volume

(Chart courtesy of Auction.com)

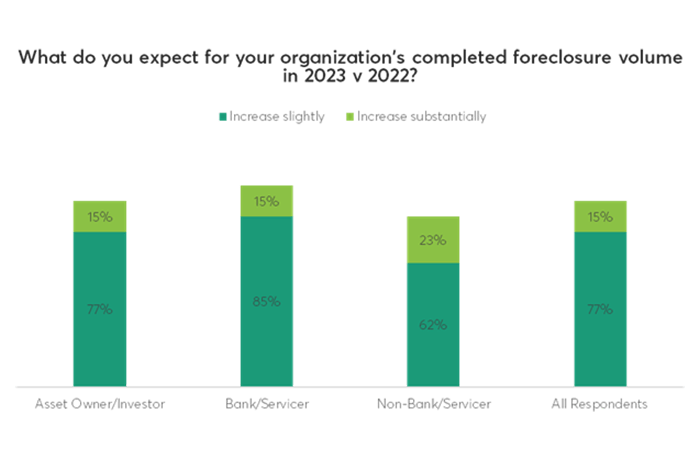

More than nine in 10 default servicing industry leaders expect completed foreclosure auction volume to increase this year compared to 2022, reported Auction.com, Irvine, Calif.

The firm’s 2023 Seller Insights report also found 85 percent of those surveyed expect home prices to decline in 2023 compared to 2022.

The report is based on a June 2023 survey of more than 50 leaders in the default mortgage servicing industry at the Auction.com Disposition Summit in Dallas. Survey respondents included default servicing leaders from mortgage asset investors, bank servicers, nonbank servicers, government agencies and government-sponsored enterprises.

Economic conditions will have the biggest impact on foreclosure volumes for the remainder of 2023, survey respondents said. They also expect roll rates from delinquency to foreclosure to continue to rebound back closer to pre-pandemic levels for the remainder of the year. Those roll rates dropped to historically low levels during the pandemic with its emergency foreclosure prevention efforts.

Nearly half–46 percent–of seriously delinquent loans insured by the Federal Housing Administration have enough partial claim capacity to fund the Payment Supplement Account that has been proposed by HUD, survey respondents estimated based on their organization’s portfolio composition.

Respondents also noted they were 32 percent confident on average that their organization could implement the PSA program within the 180-day window suggested in the HUD proposal.

Other survey findings in the report:

• 77 percent of respondents expect a “slight” increase in foreclosure volume while 15 percent expect a “substantial” increase.

• 76 percent of respondents expect home prices to decline by single-digit percentages in 2023 while 9 percent expect a double-digit decline.

• Survey respondents estimated an average loan-to-value ratio of 82.3 percent for seriously delinquent loans in their portfolio, meaning less than 20 percent equity on average.

• Respondents ranked loss mitigation delays as their top disposition challenge.