DLA Piper: Commercial Trends Vary by Class

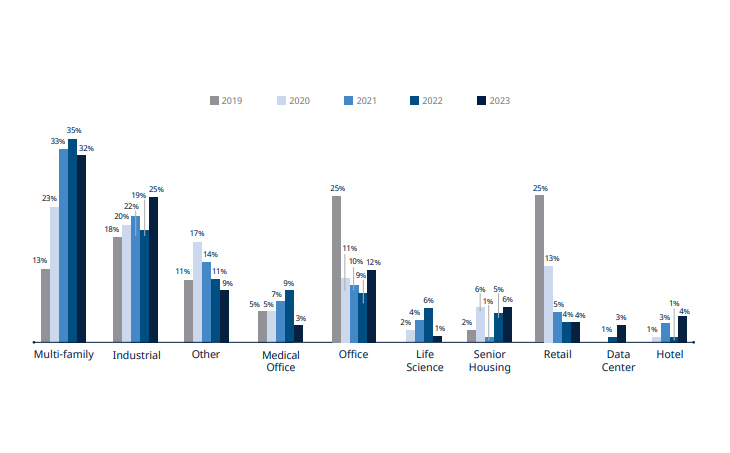

(Chart showing asset class trends in acquisition and disposition, courtesy DLA Piper)

DLA Piper, London, recently released its 2023 Mid-Year Real Estate Trends Report, highlighting activity in multifamily properties, industrial assets and other sectors.

DLA Piper noted that the trends predicted in its June 2023 Global Real Estate Annual State of the Market Survey seem to be holding true, including that current economic conditions will continue to dampen commercial real estate transactions.

DLA Piper reported the most activity in the purchase and sale of multifamily housing, with a specific increase in senior housing transactions. Also, the firm observed steady activity in leasing, land use and permitting and joint ventures.

Additionally, industrial properties–such as logistics hubs, warehouses and cold storage facilities–have shown to be attractive investments. DLA Piper reported an increase in retail, hotel and data center deals for the first half of the year, but offices continued to struggle. Life science deals slowed amid less investment in the sector.

DLA Piper noted a trend of 270-day rep/warranty survival periods in 2022, with nine months as the most frequent rep/warranty survival period in the purchase and sale agreements the firm negotiated during the first half of the year.

In terms of property management fees, DLA Piper found that the percentages varied based on asset class. All asset classes had property management fee percentages in the 3-4.99% range; industrial, life science, mixed use, and office had a substantial percentage of fees below that range.

More than 75% of multifamily property management fees were in the 3-4.99% range, but about 66% of senior housing property management fees were above 5%.

For construction management fees, DLA Piper pegged trends at the 2-2.99% range and 5%-plus range.