Life Sciences Properties Prove Resilient

Life sciences real estate assets are proving resilient during the current economic slowdown, reported CBRE, Dallas.

Among the driving factors: increased clinical trials for new drugs, persistent job growth, more federal funding and ample cash reserves for the industry’s larger companies, CBRE said in its U.S. Life Sciences Outlook.

These factors will influence the rapidly growing market for life sciences real estate, the report said. CBRE forecasts that cumulative square footage of lab space in the largest 13 U.S. life sciences markets will increase by 22% within the next two years to 220 million square feet as projects currently under construction are completed. Lab space has already expanded 47% over the past five years.

“The life sciences industry and the broader economy have hit choppy waters in recent months, but the industry’s most important gauge–the product pipeline–signals sustained, underlying growth,” said Matt Gardner, CBRE Americas Life Sciences Leader. “Many metrics have receded from their 2020 and 2021 highs, but they’re still above their pre-pandemic levels. There is a lot of promising science in the works to propel this industry forward once the lending environment settles.”

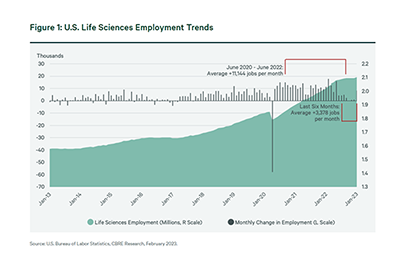

That’s not to say the life sciences sector is immune to the economic slowdown, the report noted. Recent turmoil in the banking sector will likely hamper venture capital funding this year for startup life sciences and tech companies. Initial public offerings by life sciences companies have fallen off. Job growth for life sciences professions slowed to a 4.1% gain in January from a 6.4% growth rate a year prior. And U.S. lab vacancy rose to 5.7% in last year’s fourth quarter from 5.1% in the third, though it remains low relative to many other real estate sectors.

Other indicators, especially in drug discovery and development, point to more growth for life sciences. Globally, the number of clinical trials increased to 444,567 by March, up 36% from March 2020, the U.S. National Library of Medicine reported. In the U.S., the number of new Phase 2 and Phase 3 clinical trials–when life sciences companies most often expand their operations–ramped up over the past decade to exceed 3,000 in each of the past three years.

But despite these tailwinds, lab vacancy will likely rise in many markets due to new construction, the report said. “Greater availability of lab space will provide relief for occupiers in markets like Boston, the San Francisco Bay Area and San Diego, where available space has been scarce for many years,” said Ian Anderson, CBRE Senior Director of Research.