Augie Del Rio of Gallus Insights: It’s THE Mortgage Great Depression, and We’re Flying Under the Perfect Storm

Agustin (Augie) Del Rio is Co-founder and CEO of Gallus Insights, Chicago, a Software-as-a-Service (SaaS) provider of Business Intelligence & Data Science for mortgage lenders and servicers. Prior to Gallus, he was an Investment Banking Vice President at Goldman Sachs in New York. After five years on Wall Street, he led the Financial Planning and Analysis Division at Caliber Home Loans.

The current state of the industry is depressing to say the least. After two consecutive years of record volume in 2020 and 2021, where the industry printed $3.9 and $4.3 trillion of loans, respectively, residential mortgage volume dropped to $2.2 trillion in 2022. A whopping $2.1 trillion of volume “disappeared” into the abyss. Profitability also disappeared: The industry went from a peak profit per loan of $5.5k in Q3 2020 to a record loss of $2.8k in 4Q 2022. According to the MBA, an astonishing 82% of lenders (excluding those with servicing operations) lost money during the last quarter of 2022.

I’m not typically a “Debbie Downer,” but the outlook doesn’t look great. According to Goldman Sachs, the industry will originate just $1.2 trillion in 2023. Refinancing volume will all but shut down at $176bn and purchase volume is projected to drop from $1.6tr in 2022 to $1.1tr in 2023. Interest rates will likely remain at elevated levels due to the inflationary environment while the state of the housing industry is strained by historical low levels of housing affordability and homebuyer sentiment.

I am a big fan of metaphors, and it is no exaggeration to say the mortgage industry is currently flying under the perfect storm with no sunshine or improved conditions in sight.

What are the key levers of profitability for mortgage lenders?

The mortgage business is complicated, but the actual drivers of profitability can be summarized in three key components: 1) volume, 2) revenue margins and 3) operating costs. The following formula is how I think about the business.

Volume x Revenue per Loan – Operating Costs = Lender Profits (or Losses)

I argue volume and revenue margins are largely uncontrollable. Surely, a lender can be better than its peers at recruiting (or retaining) loan officers or establishing pricing discipline in its capital market desk. However, volume ultimately depends on industry demand, while revenue margins are determined by market conditions. Thus, the lever that lenders can (and should) obsess over is the cost to produce a loan. The latter can be divided into five categories: 1) sales, 2) manufacturing/operations, 3) corporate overhead, 4) technology and 5) production support. I believe all five categories should be addressed in this market environment.

Would you get on a plane with broken flight controls?

Most lenders do not have the ability to fully understand where money is being spent. The reason is obviously not negligence. Rather, it’s the lack of resources to access, combine and manage all the data that is created during regular operations.

If you are a lender, you should be able to answer the following questions (immediately).

- What are your fixed expenses?

- What are your variable costs per loan?

- What are your unit costs per type of loan (conventional vs government)

- What are your unit costs and profitability per loan officer?

- By how much will your hedge costs decrease if you improve cycle times by 20% or 30%?

If you cannot answer one or more of the above questions, you are not alone. And this might be a significant opportunity (or your only shot) at surviving this market. Remember, most costs are related to one another. For instance, higher cycle times increase hedging expenses leading to both a revenue reduction and higher expense. It’s effectively a slippery slope if you do not have a strong handle of what is happening to the expense side of the equation. A lot of managers have been so focused on volume that they ignore how much value can be created by obsessing over expenses.

Here’s how to get started

Measure. Measure. Measure. You cannot manage what you do not (or cannot) measure.

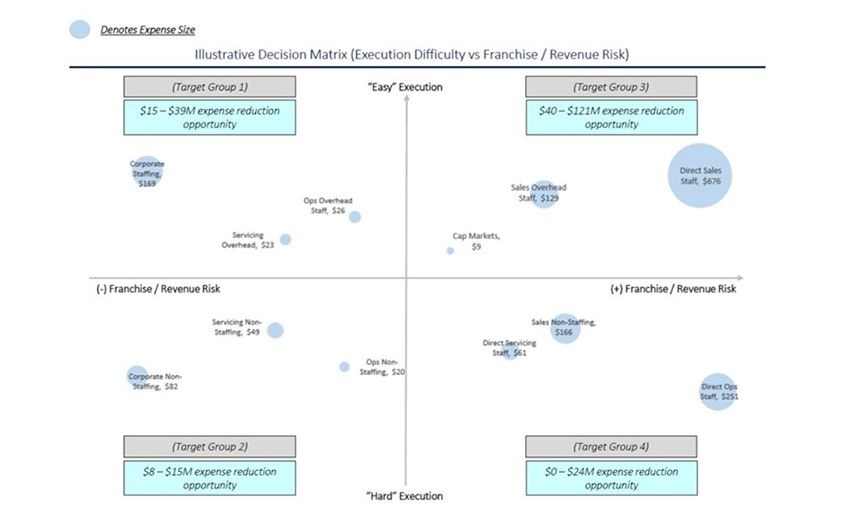

A cost optimization strategy starts with a robust mapping of your expense base. You need to understand in detail your expenses by category (per above) and type (fixed vs variable). Moreover, you should also develop a framework on how to prioritize expense reduction efforts. At Gallus, we have developed a matrix methodology that addresses “ease of execution” with “franchise risk.” The figure below illustrates categorization of expenses under such methodology.

In the example, reducing sales expenses is “easy” because it requires a simple command in your HR system. However, such a decision carries significant franchise risk given the attrition risk it would generate. Similarly, reducing vendor expenses can be difficult given the contracts and canceling implications one must assess. Such an expense reduction effort has low “franchise risk” but it’s hard to execute.

We luckily live in a world with access to technologies, allowing data to be stored, analyzed, and turned into knowledge in real-time. Several industries are fully leveraging the power of data & technology; we have self-driving cars, a thing called Chat-GPT that can write emails or essays in seconds and machine-learning algorithms that can predict your next Amazon order. When you think about it, the mortgage world is light years behind in its adoption of technology.

Every 10-15 years the mortgage league tables change dramatically. In the 2000s banks “owned” the industry. Then regulatory change led the way for non-banks to become industry leaders. The next wave of leaders will be those that use data & technology disruptively to transform the way they do business. The data revolution is here and those who embrace it will thrive, while those who ignore it will be left behind. The way I see it, the data/technology train is leaving the station. Get on it. Or buh-bye.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)