Construction Spending Dips in February

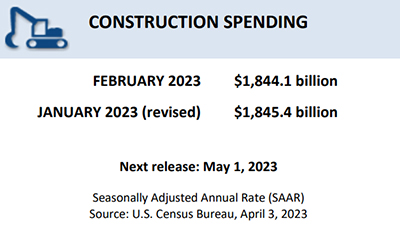

The Census Bureau on Monday reported construction spending in February dipped to a seasonally adjusted rate of $1,844.1 billion, 0.1 percent below the revised January estimate of $1,845.4 billion.

The report noted the February figure is 5.2 percent above the February 2022 estimate of $1,753.1 billion.

Construction spending amounted to $260.8 billion during the first two months of 2023, 5.9 percent above the $246.1 billion for the same period in 2022.

Census reported spending on private construction was at a seasonally adjusted annual rate of $1,453.2 billion, virtually unchanged from the revised January estimate of $1,453.6 billion. Residential construction was at a seasonally adjusted annual rate of $852.1 billion in February, 0.6 percent below the revised January estimate of $857.0 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $601.0 billion in February, 0.7 percent above the revised January estimate of $596.7 billion.

The estimated seasonally adjusted annual rate of public construction spending equaled $391.0 billion, 0.2 percent below the revised January estimate of $391.8 billion. Educational construction was at a seasonally adjusted annual rate of $84.6 billion, 0.9 percent below the revised January estimate of $85.4 billion, Census said.

“The monthly decline in total spending was largely due to another drop in the residential sector,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Total residential outlays dipped 0.6% in February, the ninth consecutive monthly decline. The overall slip in private residential spending was driven entirely by waning single-family construction. Consistent with prolonged weakness in single-family housing starts, single-family outlays in February declined for a 10th straight month, slipping 1.8%. This drop translates to a 21.4% year-over-year decline.”

Meanwhile, Dougherty noted, private multifamily construction spending expanded 1.4% in February, amounting to a 22.2% annual gain. “Multifamily outlays have now risen for seven consecutive months,” he said.