RealPage: Apartment Construction Boom Different Than The 1970s

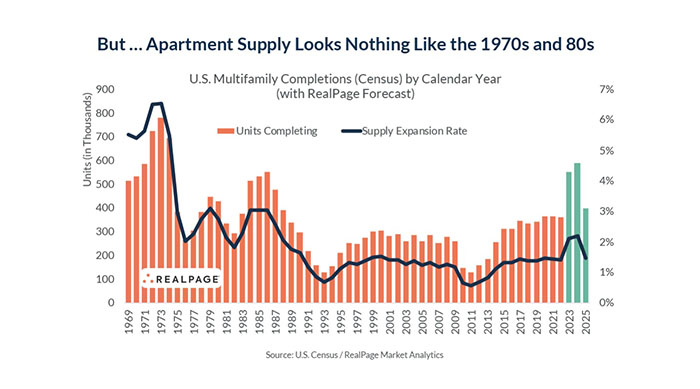

Multifamily construction is currently at its highest level in decades. But it might have less effect on the sector than you think, reported RealPage, Richardson, Texas.

“There are about a million multifamily units actively under construction nationally,” said Jay Parsons, RealPage Vice President, Head of Economics and Industry Principals. “But to say multifamily construction is at a 50-year high is equally true and terribly misleading.”

First, Parsons said, there are roughly 2.5 times more multifamily units in the U.S. today than there were in 1970, Parsons noted. “So that means one million units today has nearly one-third the impact that it had back in the early 1970s. In other words: The total number of units under construction doesn’t tell the full story. It’s the relative expansion rate that matters more.”

In 1973, new supply expanded the U.S. multifamily stock by 6.5%. But at this cycle’s peak, the inventory expansion rate will measure 2.2%, according to Census Bureau data.

In addition, multifamily starts have consistently come in around half the levels seen in the early 1970s, Parsons noted. In this cycle, starts peaked just above 600,000 units. In 1973, by comparison, multifamily starts peaked at one million units.

“Multifamily starts back then were generally smaller projects that could get approved and built much more quickly than today’s projects,” Parsons said. “So that means that projects today linger around in the total construction count longer.”

Finally, the U.S. population is much larger today than in the 1970s, so today’s construction delivers to a much larger potential renter base. There were 70 million people between age 25 and 54 in 1970, but there are nearly 130 million in that cohort today.

“With all that said, it’s important to state the obvious: we are building a lot of apartments,” Parsons said. “That will impact fundamentals, especially these next two years. But I rarely see even industry experts putting the ‘50-year high’ number in proper context. In our view, it’s not the total number at a macro level that is worrisome. We need more housing. Rather, it’s the spots with construction expanding the multifamily stock at much higher rates, like 10 or more percent in many submarkets and a few markets, especially because most of this construction targets the top quintile of renter household incomes.”

Parsons said demand will catch up to supply eventually, but there will almost certainly be a short-term supply and demand imbalance. “It’s going to be a tough road for many developers delivering lease-ups in 2023 and 2024,” he said. “But, in most cases, it probably doesn’t compare to what developers in the 1970s and 1980s experienced.”