Home Remodeling Market Expected to Top Off in 2023

Two forecasts on the home remodeling market suggest annual spending will top off by the end of 2023 and start to contract in 2024.

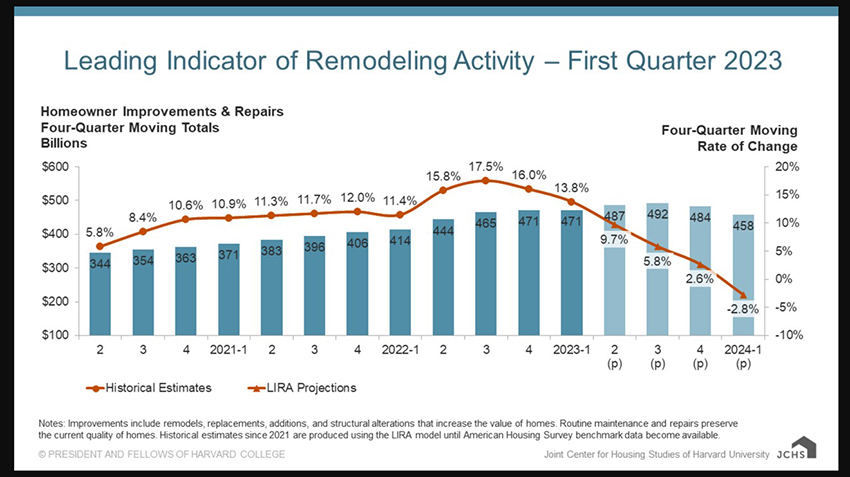

The Joint Center for Housing Studies at Harvard University’s Leading Indicator of Remodeling Activity said after more than a decade of continuous growth, annual spending on improvements and repairs to owner-occupied homes is expected to decline by early next year. The LIRA projects that year-over-year expenditures for homeowner improvements and maintenance will post a modest decline of 2.8 percent through the first quarter of 2024.

“Higher interest rates and sharp downturns in homebuilding and existing home sales are driving our projections for sluggish remodeling activity next year,” said Carlos Martín, Project Director of the Remodeling Futures Program with the Center. “With ongoing uncertainty in financial markets and the threat of a recession, homeowners are increasingly likely to pare back or delay projects beyond necessary replacements and repairs.”

“Homeowner improvement and maintenance spending is expected to top out at $458 billion in the coming year, compared with market spending of $471 billion over the past four quarters,” said Abbe Will, Associate Project Director of the Remodeling Futures Program. “However, strong and steady growth in the number of homes permitted for remodeling projects, as well as a slew of federal incentives for energy-efficiency retrofits may yet buoy remodeling expenditure from steeper declines.”

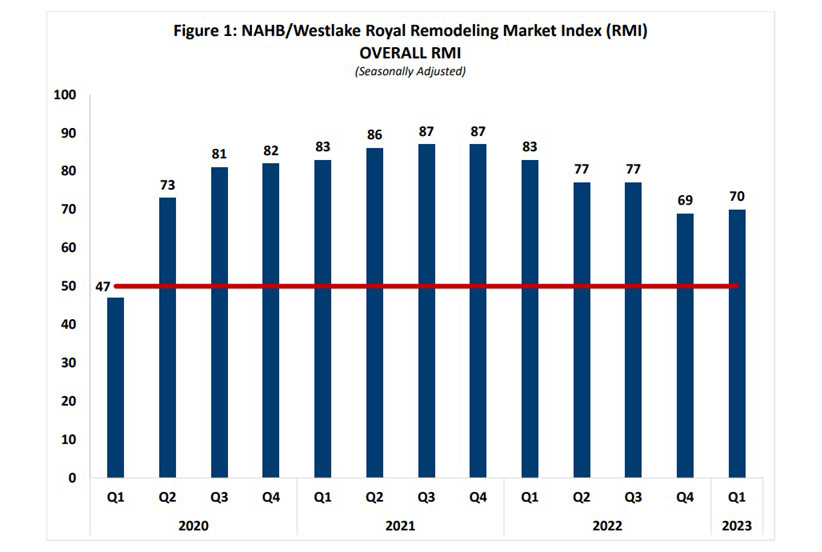

Separately, the National Association of Home Builders//Westlake Royal Remodeling Market Index came in at 70 in the first quarter, edging up one point compared to the fourth quarter. However, NAHB also expects a gradual slowing in remodeling activity toward the end of 2023.

“Remodelers are generally optimistic about the home improvement market, although some are noting negative effects of material shortages and higher interest rates,” said NAHB Remodelers Chair Alan Archuleta, a remodeler from Morristown, N.J. “Customers are still undertaking larger projects, but are mostly paying cash rather than financing them.”

“An overall RMI of 70 is consistent with NAHB’s projection that the remodeling market will grow in 2023, but at a slower pace than in 2022,” said NAHB Chief Economist Robert Dietz. “One potential area of growth, given the aging U.S. population, is aging-in-place remodeling. In fact, 63% of remodelers reported in the first quarter doing aging-in-place work, with bathroom projects like grab bars and curb-less showers being particularly common.”

NAHB reported the Current Conditions Index averaged 75, dropping two points compared the previous quarter. Two of the three components declined as well: the component measuring large remodeling projects ($50,000 or more) fell three points to 71 and the component measuring small remodeling projects (under $20,000) declined by two points to 77. Meanwhile, the component measuring moderately-sized remodeling projects (at least $20,000 but less than $50,000) remained unchanged at 78.

The Future Indicators Index increased two points to 64 compared to the previous quarter. The component measuring the current rate at which leads and inquiries are coming in rose two points to 59 and the component measuring the backlog of remodeling jobs increased two points to 69.