Home Sellers See Further Declines in Profits

ATTOM, Irvine, Calif., reported profit margins on median-priced single-family home and condo sales across the United States decreased to 44.2 percent in the first quarter as home prices stayed flat or kept declining around most of the nation.

The company’s quarterly U.S. Home Sales Report said the drop-off in typical profit margins, from 48.7 percent in the fourth quarter, marked the third straight quarterly decrease nationwide and resulted in the lowest investment return since mid-2021. It came as the national median home price rose just 1 percent quarterly, to $321,135, and values commonly went down in almost three-quarters of major housing markets around the country.

The report noted typical investment returns nationwide did remain high in the first quarter – nearly double where it stood four years ago. But the margin was off by 12 points from the peak of 56.1 percent hit in the second quarter of last year.

“Homeowners are starting to take a significant hit in the form of lost profits from the recent market slowdown. Nine months of varying price declines around the country have carved away almost a quarter of the profit margin sellers were enjoying in early 2022. That’s a striking reversal of what we saw for a decade,” said Rob Barber, CEO of ATTOM. “It is possible that the upcoming peak buying season of 2023 could lead to increased profits, owing to favorable mortgage rates and other factors. Over the next few months, we can expect to gain more clarity regarding whether the current market stagnation is a short-term aberration or a more significant trend.”

The report said the latest round of faltering profits and prices around the U.S. reflects a housing market that has been stalled since the middle of last year following a decade of nearly continuous gains. The nationwide median home price fell 7 percent from the record hit in the second quarter of last year, taking profit margins with it.

ATTOM said typical profit margins – the percent difference between median purchase and resale price – stayed the same or went down from the fourth quarter in 93 (68 percent) of the 137 metropolitan statistical areas around the U.S.. They were flat or down in 123, or 90 percent, of those metros compared to the second quarter of last year, when returns hit a high point nationwide. Metro areas were included if they had a population greater than 200,000 and at least 1,000 single-family home and condo sales in the first quarter of 2023.

Other report findings:

–Profits on median-priced home sales, measured in raw dollars, stayed the same or decreased from the fourth quarter in 100, or 73 percent, of the metro areas analyzed for this report.

–Median home prices in the first quarter decreased or remained the same compared to the prior quarter in 104 (75 percent) of the 139 metro areas around the country with enough data to analyze, although they were still up annually in 102 of those metros (73 percent). Nationally, the median first-quarter price of $321,135 was up 1 percent from $318,000 in the fourth quarter of 2022 and up 1.6 percent from $316,000 in the first quarter of last year.

–Home prices hit new highs during the first quarter in only six of the 139 metro areas in the report.

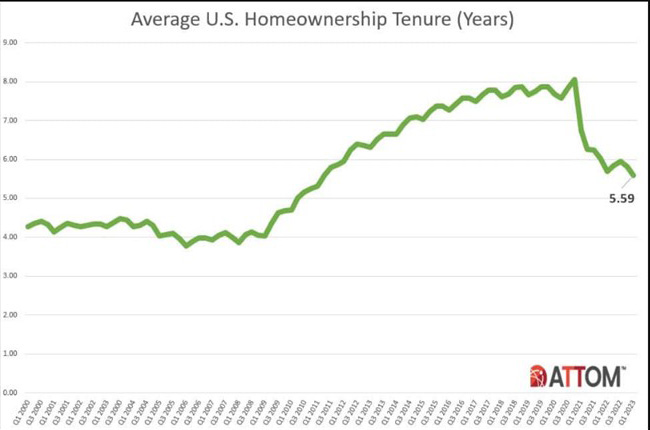

–Homeowners who sold in the first quarter had owned their homes an average of 5.59 years. That was down from 5.81 years in the fourth quarter and 5.68 years in first quarter 2022 to the lowest point since mid-2011.

–Nationwide, all-cash purchases accounted for 39.3 percent of single-family home and condo sales in the first quarter, the highest level since first quarter 2013. The latest portion was up from 37.9 percent in fourth quarter 2022 and up from 36.9 percent in the first quarter of last year.

–Institutional investors nationwide accounted for 5.4 percent, or one of every 19 single-family home and condo purchases in the first quarter, down from 6.6 percent in the fourth quarter and from 6.1 percent a year ago.

–Nationwide, buyers using FHA loans comprised 8.3 percent of all single-family home and condo purchases in the first quarter (one of every 12). That was unchanged from the fourth quarter and up from 7.3 percent a year earlier.