CBRE: Office Sublease Space Nearly Doubles Since Pandemic

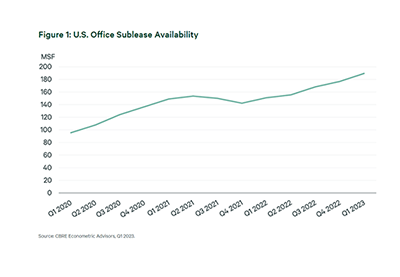

CBRE, Dallas, said office sublease space has nearly doubled since the COVID pandemic began in early 2020, ushering in hybrid working arrangements.

In an Office Brief, CBRE said the 189 million square feet of sublease space available in the first quarter accounts for 19% of total office availability, up from 96 million square feet or 13% of total office availability in first-quarter 2020. About half of this sublease space sits vacant, contributing to the overall office vacancy rate of 17.8% as of first-quarter 2023. If the remaining 86.4 million square feet of sublease space currently reported as occupied were to become vacant, the overall vacancy rate would rise by another 2 percentage points.

The report noted the amount of sublease space varies by industry. Technology companies account for 23% of all sublease availability, followed by finance and insurance and business and professional services firms, each with a 15% share, CBRE said. All other industry sectors each account for 9% or less.

“Small spaces comprise the greatest number of sublease availabilities as occupiers trim and optimize their portfolios,” the report said. Nearly 40% of sublease space blocks are between 10,000 and 20,000 square feet and nearly 80% are under 50,000 square feet. While fewer in number, large blocks (100,000 OR more square feet) are significant contributors to overall sublease availability and total 55.7 million square feet, the greatest square footage amount of all size segments.

“Markets with the most sublease availability include Manhattan, Chicago and Washington, D.C.,” the report said. “Technology and finance and insurance occupiers–two of the sectors most active in adding sublease space–are among the largest tenants in these markets.”

Rising office sublease availability is challenging market dynamics for property owners, but it presents more opportunities for tenants searching for space, CBRE noted. Sublease space typically rents at a 20% to 40% discount depending on the market, class and remaining term.

“Office landlords with direct space offerings will face more competition as occupiers continue to optimize their portfolios and add discounted and fully built-out sublease space to the market,” CBRE said.