MBA/Urban Institute Report Finds IMB Lending to Minority Neighborhoods/Borrowers Exceeds Banks

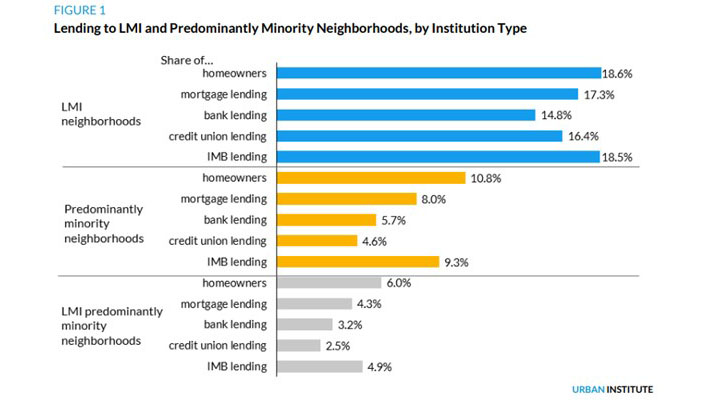

A report by the Urban Institute, commissioned by the Mortgage Bankers Association, found independent mortgage bank lending to low- and moderate-income neighborhoods, predominantly minority neighborhoods and LMI predominantly minority neighborhoods is much higher than bank lending in those neighborhoods.

“This analysis is robust at both the national level and across most of the states we looked at,” the report said.

The report, An Assessment of Lending to LMI and Minority Neighborhoods and Borrowers, looked at the state of lending to LMI borrowers and neighborhoods and minority borrowers and neighborhoods at the national level and for five states that have implemented or are considering extending Community Reinvestment Act requirements to IMBs. Its authors included Laurie Goodman, Linna Zhu, Katie Visalli, Ellen Seidman and Jun Zhu of the Urban Institute. The report was prepared in collaboration with and funded by MBA.

The report found at the national level, LMI neighborhoods receive less mortgage lending than their share of current homeowners, as do predominantly minority neighborhoods and LMI predominantly minority neighborhoods. This was also true across seven states examined: Pennsylvania, Washington, Oregon, Connecticut, Rhode Island, New Mexico, and New Jersey, plus Washington, D.C., that have had some discussions on broader CRA adoption; legislation was introduced in Pennsylvania in March.

“Comparing lending by banks (who are subject to the CRA) with lending by IMBs (who are not subject to the CRA, except in Massachusetts), we find that IMB lending to LMI neighborhoods, predominantly minority neighborhoods and LMI predominantly minority neighborhoods is much higher than bank lending in those neighborhoods,” the report said. “At the national level, LMI borrowers receive less than their proportionate share of mortgage lending, as measured by existing homeowners, while minority borrowers receive more mortgage lending than their share of current homeowners.”

Furthermore, the report said much of this positive discrepancy between the share of loans to minority borrowers and the share of existing minority homeowners “is attributable to the very high share of IMB lending to LMI borrowers and minority borrowers, significantly higher than the bank share.”

CRA was enacted in 1977 to encourage banks to meet the credit needs of the communities where they do business, especially in low- and moderate-income areas within those communities. The act was also conceived of as a piece of civil rights legislation designed to overcome the effects of America’s history of redlining, under which lenders refused to lend, especially for home mortgages, to Black, Latino, and ethnic white households. The CRA requires banking regulators to “assess the institution’s record of meeting the credit needs of the entire community, including low- and moderate-income neighborhoods, consistent with the safe and sound operations of such institutions.”

Importantly, CRA applies only to banks and thrifts—entities regulated by the Federal Reserve, the Office of the Comptroller of the Currency, or the Federal Deposit Insurance Corp. In particular, the CRA does not apply to credit unions or independent mortgage banks. This reflects the state of financial services in 1977, when most mortgage credit was provided by banks and thrifts, all of which operated out of branches, many with limited geographic reach. In 2022, though, IMBs accounted for 60 percent of all mortgage originations, including 75 percent of originations backed by Fannie Mae, Freddie Mac, the Federal Housing Administration, and other government agencies. And that share has been rising; early-2023 numbers put the share of total agency originations by nonbanks at more than 80 percent.

Three states—New York, Massachusetts and Illinois—have adopted versions of the CRA that now cover nonbank mortgage lenders, including IMBs, in addition to banks, though only Massachusetts has implemented that part of the statute. In addition, federal bank regulators are in the process of a major update of the CRA regulations.

The report noted racial and economic discrepancies in mortgage lending were at the heart of the decision to adopt the federal CRA back in 1977. The continued—and in some cases widening—racial homeownership and wealth gaps demonstrate the continued salience of that decision. But the report said the structure of home mortgage lending has changed significantly since 1977; in particular, IMBs now originate more mortgages each year than do banks subject to the CRA.

Some states have responded by including IMBs in state CRA regimes, while other states that are considering adoption of state-level CRA laws are looking at whether to include IMBs. “Meanwhile, despite the fact that IMBs are currently examined under CRA rules only in Massachusetts, IMBs are significantly more active in LMI and minority lending than their bank counterparts,” the report said. “The data and analysis in this report may prove useful to the states as they continue their deliberations.”