Cushman: Now is the Time to Fight Climate Change

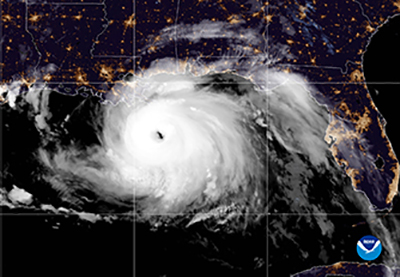

(Hurricane Ida, 2021)

As sea levels rise, the reality of climate change’s impact on the commercial real estate industry is becoming clearer, reported Cushman & Wakefield, Chicago.

In a report, Now is the Time: Commercial Real Estate Can Make a True Impact on Climate Change, Cushman noted when Hurricane Sandy struck New York in 2012, flooding hit more than 90,000 buildings, disrupting commercial activity and costing the city nearly $20 billion. “We must act now to avoid the magnitude and very real risk of long-term social and economic disaster,” the report said.

Cushman said this reality came into focus in March when the U.N. Intergovernmental Panel on Climate Change released its 2023 Report on Climate Change. “[The report’s] message is clear: the consequences of human-induced global warming will only worsen extreme weather events, putting countries, cities and people at risk,” Cushman said. “For the real estate industry, there is a very real opportunity to address climate change by decarbonizing buildings and achieving net-zero emissions across the globe.”

The Mortgage Bankers Association’s Research Institute for Housing America has explored the impacts of climate change on the real estate finance industry, recently publishing a collection of essays on the subject.

“RIHA asked a group of experts in their fields to weigh in on this important topic,” said Edward Seiler, RIHA Executive Director and MBA Associate Vice President of Housing Economics. “These essays address the impacts of climate change and how the industry can prepare for increased regulatory and investor scrutiny on the quantitative estimates of climate-related risks. It is important to understand how climate change may impact the housing industry and its customers.”

The publication, A Collection of Essays on Climate Risk and the Housing Market, was developed in response to growing interest from industry participants on how various issues connect to climate risk. The study features four essays from industry experts that focus on topline issues related to climate risk and its impact on the housing market.

Climate risk can be magnified by the built environment’s development, location and socioeconomic factors, Cushman noted. “For example, in New York City, the southern tip of Manhattan is already at risk from flooding, and some of the world’s most expensive real estate–around $130 billion in building value–exists within existing floodplains,” the report said. “We’ve reached a place in time when some of the richest cities in the world are facing dire social and economic consequences because of climate change.”

The IPCC report found a 50% chance that global temperatures will grow by 1.5 degrees Celsius before 2040. If high emissions continue, temperatures could increase by up to 5.7 degrees Celsius by 2100, IPCC said.

“Reducing greenhouse gas emissions is not enough; we must also remove carbon from the environment,” Cushman said. “The IPSS finds that there is no pathway to 1.5 degrees Celsius that does not require decarbonization.”

The IPCC listed several ideas the real estate industry can implement to mitigate climate change, including retrofitting and decarbonizing buildings, investing in clean energy and efficiency, decarbonizing the cement, steel and plastics used in buildings and locating commercial buildings in an area well-served by public transport and with facilities for bike storage, showers and lockers.

Carbon reduction is not solely the responsibility of the fossil fuel industry, Cushman noted. “We all need to make major changes to how we live our lives and operate our businesses,” the report said. “It is not sufficient to look to replace fossil fuels with an alternative. The bottom line is that we must simply reduce the amount we consume.”