Murali Tirupati of Vaultedge: Rising Interest Rates and their Effect on the Housing Market

Murali Tirupati is a serial entrepreneur, CEO & co-founder of mortgage automation startup Vaultedge (www.vaultedge.com) helps mortgage lenders, servicers & investors automate document processing to reduce loan production, boarding & due diligence cost. He has 21 years of enterprise software consulting and sales experience.

Homeownership has long been acknowledged as a core element of the American dream, as it confers several economic benefits on homeowners, including the ability to collect wealth by accessing credit, building equity, and reducing housing costs. According to data from the U.S. Census Bureau, homeownership has remained consistently above 60% since the 1960s.

However, home buyers, particularly first-time homebuyers face several common limitations while buying a home – difficulties in putting together a sufficient down payment, exhausting levels of student loan debt, and the inability to access credit. In addition to these typical financial hurdles, current boom conditions in the real estate market, rising interest rates, and inflation are placing additional constraints. In short, you can say, buying a home today is more difficult than it was over the last couple of years.

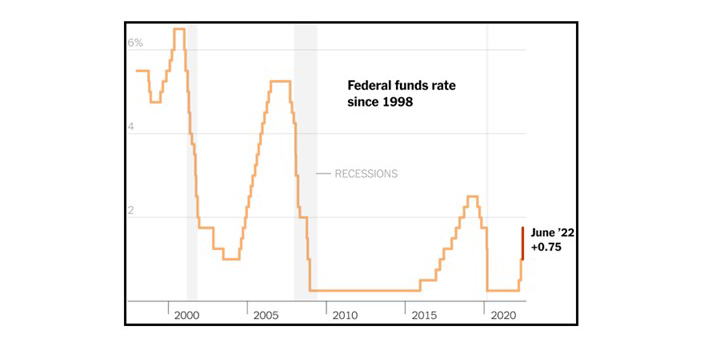

Now, in an attempt to stabilize the economy, the Federal Reserve raised interest rates in March 2022. This was followed by another rate hike in May and June, to regulate inflation. The most recent rate hike was announced on July 27 and enacted its second consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 2.25%-2.5%. This is the largest Fed rate hike since 1994.

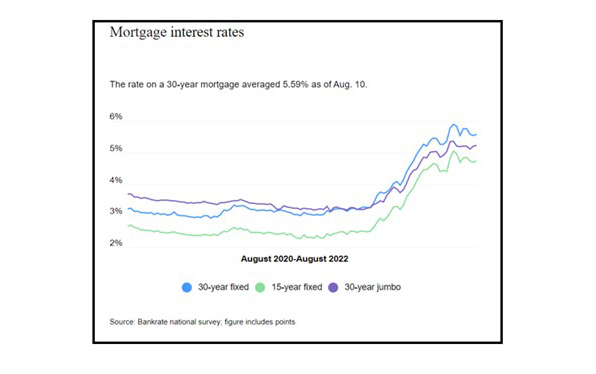

The Federal Reserve does not set mortgage rates, but the central bank’s decisions indirectly impact them. Mortgage rates usually move in line with 10-year Treasury yields. Thus, when the Fed makes decisions that raise or lower interest rates in general, this also affects mortgage rates.

But while the Fed may influence mortgage rates, it is ultimately lenders and investors who decide what rate to offer based on market conditions and other factors.

The housing market has been cooling off lately, with prices rising more slowly and more inventory available. This is good news for buyers who have been struggling to find affordable homes. However, we have to wait and see how long this trend continues.

So, if you’re shopping for a mortgage, be sure to compare rates from multiple lenders to get the best deal possible.

What factors affect interest rates?

The most pertinent question here is why the mortgage interest rates fluctuate. Well, there are several factors to be the considered-the economy, the Feds decisions, the bond market, inflation, and then there is your personal credit history.

So, before we delve into the details, let’s first understand an interest rate. Simply put, an interest rate is an additional charge imposed by a lender on top of the principal amount borrowed by a borrower. This fee is typically given as a percentage of the total loan and is paid to the lender for the use of their assets.

The Federal Reserve

Now, primarily the mortgage rates are determined by the country’s national bank. In this case, the Federal Reserve usually sets the interest rate, which each bank will use to calculate the range of annual percentage rates (APRs).

The Fed directly controls short-term interest rates. They do that by increasing them or decreasing them based on the state of the economy. While mortgage rates aren’t directly tied to the Fed rates as mentioned earlier, when the Fed rate changes, the prime rate for mortgages usually follows suit soon.

The Federal Reserve oversees short-term interest rates to control the money supply. When the economy is stumbling, the Fed lowers rates. These are not the rates that are meant for customers directly, but the rates at which banks can borrow money to lend to consumers.

And when the Fed decides they need to constrict the money supply, they raise the Fed rate. While the Fed does not direct the banks to increase mortgage rates, banks and lenders must follow suit to keep up with their costs to borrow money from the Fed.

The Bond Market

We don’t tend to consider the influence of the bond market directly when it comes to indulging in a personal activity such as buying a house. But at the end of the day, mortgages are just a big financial agency. Like a lot of financial products, mortgages can be traded among investors. This specific instrument for trading home loans is a mortgage bond. Also known as

mortgage-backed securities (MBS). Mortgage bonds are collections of loans with similar characteristics such as down payment amount, credit score, and the original investor in the loan.

One of the key things to note is that the bond market in general is taken to be a safer place to invest than the stock market. Bond prices and mortgage interest rates have an inverse connection with one another. When bonds are more expensive, mortgage rates are lower. And when the mortgage rates are skyrocketing, the bonds tend to become affordable.

The economy in general

Mortgage rates deviate based on how the economy is doing today and its outlook. When the economy is thriving- that means unemployment rates are low and spending is high, it increases consumer confidence and spending, robust GDP growth, and a solid stock market tends to push mortgage rates higher. That’s because the higher demand results in more work for lenders who only have so much money to lend and manpower to originate loans, and mortgage rates increase.

On the other hand, when the economy descends and unemployment rates increase, interest rates fall to make it more affordable for borrowers to take out loans. And in these times, investors lean toward safe-haven investments like Treasury bonds and mortgage bonds, escalating bond prices but the results on those bonds are lower.

Inflation

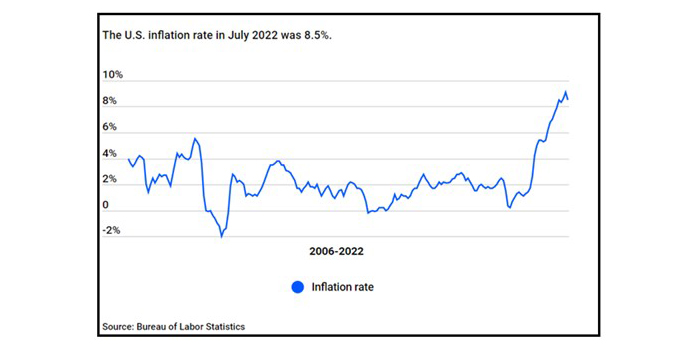

Inflation also plays a significant role. When inflation surges, people are more incentivized to invest in stocks. The reason is that the guaranteed rate of return on bonds gets eaten as inflation rises. Escalating inflation constricts buyers’ purchasing power, this factor is considered by lenders when mortgage rates are set.

Lenders must adjust mortgage rates to a level that makes up for reduced purchasing power when inflation surges. Beyond everything, lenders still need to earn a profit on the loans they originate, and that becomes complicated when consumers’ buying power is reduced. Inflation has spiked to its highest level in four decades, hitting 7.9 percent in February 2022. That takes us back to our statement about the Fed trying to restrain the soaring prices by increasing the rates.

Personal credit and financial history

This is all about the consumer’s creditworthiness. Lenders assess if a borrower can and will repay the mortgage, and they do that by assessing the risk of default. The consumer’s credit score is the most crucial indicator of his/her ability to manage debt and pay bills on time. Consumers with lower credit scores pay increased interest rates and avail more-limited loan alternatives if their credit is less than the benchmark.

Lenders also note the debt-to-income or DTI ratio. Generally, the higher the DTI ratio, the riskier the borrower appears (on paper) to a lender, consequently, the interest rate will be higher. As mortgage rates sink, the DTI ratio falls, too, because a lower rate will drop the monthly mortgage payment, which is included in the DTI ratio calculation. As a result, homeownership will no longer be a dream, a borrower can afford to buy a house.

When demand for mortgages increases, lenders may have to consider the spike in and bear the processing costs involved usually by hiking mortgage pricing. Similarly, when demand is dull or falls, lenders have to adjust pricing to attract business and keep the shutters open.

Importance of interest rates to the housing market

So, we have spoken about the factors that influence mortgage interest rates. Now let’s understand why these rates are important to the housing market. This is because they directly affect the purchasing power to own a property. Also, interest rates play a big role in influencing the value of real estate. When interest rates are low, there is usually a rise in demand for properties which then drives up prices.

On the other hand, when interest rates are high, it generally has a contrasting effect. The rate hike immediately stimulates current homeowners to stay put because they’re “locked in” to the great low rates they obtained in the past few years. It also eliminates prospective homebuyers who now have to think about higher interest rates adding hundreds of dollars a month to mortgage payments on homes that are already priced high.

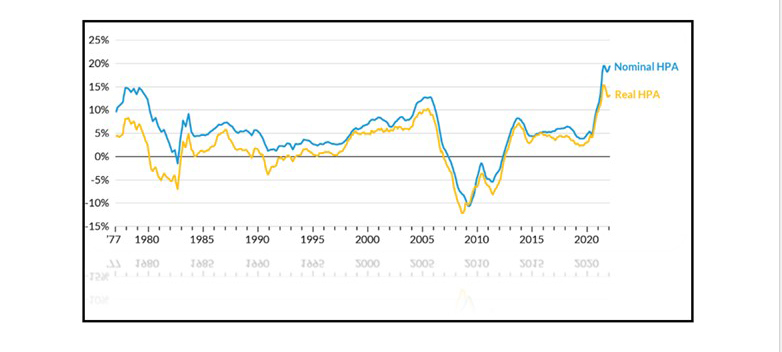

Historically, the relationship between mortgage rates and home prices does not address how home price appreciation changes when interest rates rise quickly. Mortgage rates in the United States have dropped since 1976, so there have been a few periods when interest rates have grown more than 1.5 percentage points year over year. Two periods during which rates rose quickly were from September 1979 to March 1982 and from September 1994 to February 1995.

During these periods, the rate of home price appreciation slowed down. From September 1979 to March 1982, home price appreciation decelerated from 12.9 percent to 1.1 percent. And from September 1994 to February 1995, it decelerated from 3.2 percent to 2.6 percent. During the housing bubble of 2004 to 2007, mortgage rates rose again and prices soared.

We have spoken about how the Fed’s decision controls the mortgage rates, affecting the housing market. However, mortgage rates don’t necessarily grow simultaneously with the Fed’s rate increases. They can even move in the opposite direction. Long-term mortgages tend to follow the rate on the 10-year Treasury note, which, in turn, is impacted by a combination of factors. These incorporate investors’ expectations for future inflation and global demand for U.S. Treasurys. As of now, mounting inflation and strong U.S. economic growth are pushing the 10-year Treasury rate higher.

There have been a lot of hypotheses, but little proof, about what higher rates do to home price appreciation. The historical evidence divulges that sharply higher mortgage rates slow home price appreciation and may affect housing market activity. The good news is that nominal home price appreciation does remain positive.

The extensive millennial generation has now entered its prime home-buying years, and the housing market won’t cool by much. Despite a strong drop in affordability owing to higher mortgage rates, home prices are unlikely to fall. Instead, affordability challenges are likely to stay.

What should the borrowers keep in mind?

The Fed’s purpose is to butcher overall inflation, but the weird circumstances caused by the pandemic mean that the housing market might not obey. A borrower in such times needs to be flexible.

Intelligent shopping can help the consumer find a better-than-average rate. Various options need to be considered like the bank, local credit union, online lenders, and more. Enquiring about rates, loan terms, down payment requirements, mortgage insurance, closing cost, and fees of all kinds, and comparing these details on every offer will be a smart move.

A consumer needs to stay away from ARMs. ARMs should not be used as a crutch of affordability. An ARM can be a good idea if the borrower’s life is likely to change in the next few years, for example, if the purchased house is sold or the owner moves cities. The borrower can yield the benefits of the ARM’s fixed-rate period and sell the house before it gets over and the less-predictable adjustable phase commences. The new adjustable mortgage products are structured to alter every six months rather than every 12 months, which had previously been the case.

With the refinance boom slowing, lenders are eagerly waiting for more business. Borrowers need to keep a cash-out mortgage in mind. While mortgage refinancing diminishes, it can still come to the rescue in certain cases.

Bottom line

The collective impact of higher mortgage rates, rising home prices, and dread of recession, has created a substantial dent in the housing-market activity. A few economists have predicted that Sluggish demand will likely persist throughout the third quarter of this year. This will be characterized by year-over-year drops in home sales as well as a slowing of home price growth on a year-over-year basis. More price reductions will be witnessed too, partly due to seasonality, but also as sellers contend with the reality of slower buyer demand.

Existing-home sales have declined for five straight months, according to the most recent data from the National Association of Realtors but the market traditionally accelerates again during back-to-school season.

While they’re certainly not likely to plunge back down to the record lows of early 2022, mortgage rates do seem to be stabilizing. Buyers who have lost out on countless offers over the last two years may feel inspired to approach the market again instead of sitting on the sidelines. There is going to be less competition and the absence of the bidding wars of the last two years.

Finally, they may get a chance to partake in the ideal feature of the American dream- homeownership.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)