MBA Chart of the Week: Quarterly NCREIF Property Returns

Federal Reserve Board Chair Jerome Powell warned at Jackson Hole, Wyo., last month, “Inflation is running well above 2 percent, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

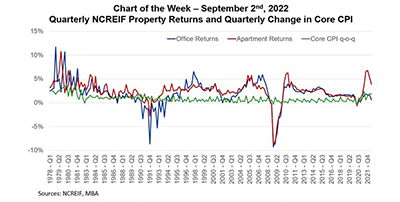

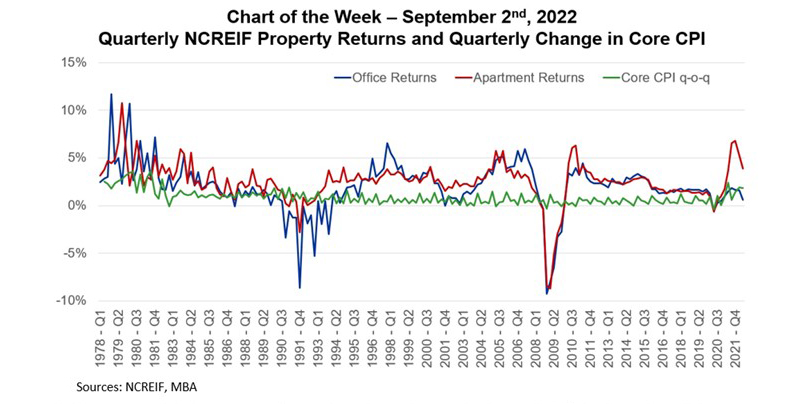

With the Google search “is commercial real estate a hedge against inflation?” now returning 6.8 million results, it is worth revisiting why commercial real estate might serve as a hedge. In many discussions, people point to the flexibility of leases to capture rising prices – either through direct renewals in shorter-lease assets like self-storage and apartments, or through escalation clauses tied to the Consumer Price Index or other measures in longer-lease assets like office or industrial. In such cases, property net incomes can outpace inflation if lease revenues rise faster than property expenses by a healthy margin.

A 2021 analysis by NAREIT found “Over the 20-year period [2000-2020]… REITs’ average annual dividends per share growth of 9.4 percent (or 8.4 percent compounded) compared to only 2.1 percent (2.0 percent compounded) for consumer prices.” An analysis by Brookfield-Oaktree found that during periods of rapid spikes in consumer prices, total returns of private real estate outpaced inflation by factors of 1.6 to 2.0. As far back as 2011, Martha Peyton found “U.S. commercial real estate investment performance history is more strongly correlated with inflation history than is performance of Treasurys, stocks, bonds or REITs.”

Most compelling is the fact that the lion’s share of the expenses driving properties’ incomes – namely the construction of the building – happened prior to any current inflationary period. Once a building is built, those expenses are locked-in at the pre-inflation level. In terms of direct impact, consider the fact that assessing a property’s value is dependent on three methods, one of which is cost-basis – essentially baking into a property’s value any increases in construction cost between when the property was built and today. Those benefits are of course super-charged to the degree those earlier expenses were financed through long-term debt that is priced at a lower, pre-inflation mortgage rate.

The forward path of inflation remains a topic of great debate and conjecture. How that path plays into the relative benefits of different investment options – including commercial real estate and other real assets – will give us even more insights into the relationship.

–Jamie Woodwell jwoodwell@mba.org.