Rising Labor, Land Costs Impacting Seniors Housing Development

Seniors housing development costs have risen sharply over the past two years, driven primarily by labor and land, said CBRE, Dallas.

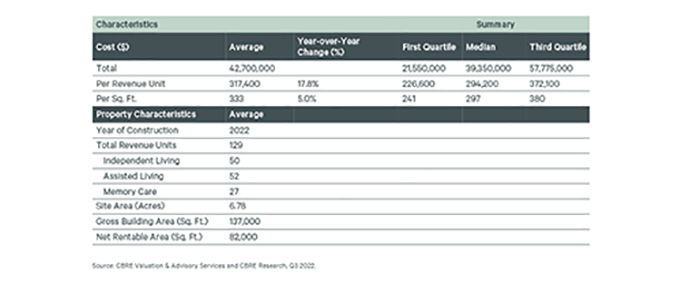

CBRE reported the average cost of a seniors housing development has increased by 17.8% since 2020 to $317,400 per unit or $333 per square foot.

Seniors housing average returns (stabilized net operating income as a percentage of overall development costs), fell to 8.6% in the first half of 2022 compared with 9.6% in first half 2020. CBRE attributed the decrease to significant higher input costs combined with slightly slower market rent growth.

Hard costs such as labor, sitework, foundation, building shell construction and roofing represent the largest portion of total development cost at 70.2%, followed by soft costs including inspection fees, construction loan-related costs, architectural/design costs and project management at 18.5% and site acquisition costs at 8.2%.

“The cost to develop a seniors housing project is rising sharply, fueled by higher labor and materials costs, operating deficit reserves and entitlement outlays,” said Daniel Lincoln, National Practice Leader of Seniors Housing & Healthcare for CBRE Valuation & Advisory Services. “Due to a slow post-COVID recovery in occupancy, market rents have been below the level needed to support new development in many markets; a more balanced market could be on the horizon as many high-end communities are fully occupied and poised for rent increases.”

Lincoln said he expects above-average rent growth for core assets in most major U.S. markets next year given the gap between average contract rent at seniors housing communities delivered between 2016 and 2021 and the rents required today to justify new development.

CBRE examined the valuations of 142 seniors housing developments scheduled for delivery in the report. The properties in the data set include independent living, assisted living and memory care communities.