A Decade in the Making: KBRA on SFR Trends and Outlook

More than a decade ago, marketplace dialogue arose about the feasibility of securitizations backed by diversified pools of single-family rental properties. Invitation Homes issued the sector’s first transaction in November 2013. That securitization, IH 2013-SFR1, was collateralized by a single $479.1 million floating-rate loan secured by first mortgages on 3,207 income-producing SFR homes. More than $70 billion in SFR bonds have been issued since then.

KBRA, New York, recently published a report, SFR Securitizations: A Decade in the Making, analyzing the sector’s evolution and growth. MBA Newslink interviewed the report’s authors about the factors driving the sector’s growth.

Nitin Bhasin is a Senior Managing Director and the Global Co-Head of KBRA’s CMBS Group. He manages issuance and surveillance of credit ratings for Conduit, Single-Borrower, CRE collateralized loan obligation, SBC and SFR securitizations and sits on the firm’s credit policy and operating committees. Previously, Bhasin was a Vice President at Wells Fargo Securities, where he worked on the CRE securitization and net lease investments and advisory desks.

Akshay Maheshwari is a Senior Director in KBRA’s CMBS ratings group, with experience across a variety of transaction types including conduit, agency, single-asset single borrower, CRE CLO, large loan, small balance commercial and single-family rental securitizations. He has participated in the ratings process of nearly $300 billion in CRE securities across 400-plus transactions.

MBA NEWSLINK: What different types of transactions have come to market in the SFR space?

NITIN BHASIN: There are two types of transactions that have been most prevalent over the past ten years: single-borrower and multi-borrower transactions. The vast majority (83.7% by count, 92.4% by balance) of SFR securitizations have been single-borrower structures, which are collateralized by a single loan made to a single borrower, typically sponsored by large-scale institutional property owners.

For single-borrower transactions, the loan is secured by mortgages on numerous free-standing rental homes, often numbering in the thousands, that are typically dispersed geographically. To date, 113 single borrower SFR transactions (70 KBRA-rated) have been issued by 16 sponsors, with an aggregate principal balance of $69.6 billion collateralized by approximately 355,000 underlying properties at issuance.

Multi-borrower transactions are typically collateralized by a pool of loans that exhibit diversity relative to loan count as well as borrowers. The loan count in these transactions has ranged between 16 and 211 with a median of 85, which are made to a mix of institutional mid-scale and mom-and-pop borrowers. The assets underlying the loans vary considerably in type (SFR, duplex-fourplex, condos, townhomes) and count (less than a dozen to hundreds of properties). Some loans may also be secured by traditional multifamily properties in these transactions. A total of 22 multi-borrower SFR securitizations (17 KBRA-rated) have been issued since 2015 by three different sponsors, with an aggregate principal balance of $5.8 billion, which included 2,115 loans secured by approximately 59,000 rental properties included at issuance.

NEWSLINK: What have issuance volumes been historically for SFR operators/lenders tapping the capital markets to finance their businesses?

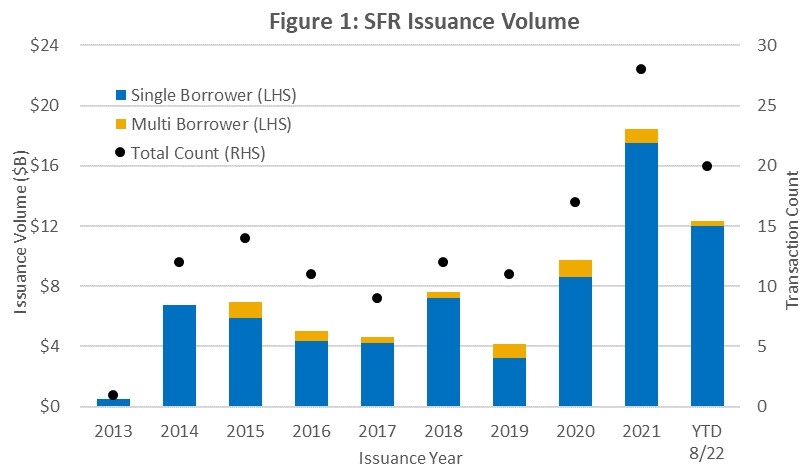

BHASIN: Issuance volumes have hovered around $6 billion on average for several years. The sector experienced a surge in volume following the onset of the pandemic as demand for single-family rentals increased, and so did investor appetite for securities collateralized by these rentals. Transaction size has generally been on the rise over the years, with an overall average of $685 million and in the range of $271 million to $2.5 billion. While some of this is driven by a larger property count in certain years, much of this trend is due to home price appreciation and increasing leverage.

In 2021, issuance reached its highest level, at $18.4 billion, while 2022 continues to see robust volume ($12 billion as of August 22 versus $9.1 billion during the year-ago period) despite capital market disruptions owing to increasing interest rates and inflation, and recessionary concerns.

SFR Securitization Issuance Volume Since Inception

NEWSLINK: Who has issued SFR securitizations and how have these entities evolved?

AKSHAY MAHESHWARI: The earliest single-borrower SFR transaction sponsors emerged during the aftermath of the Great Recession, when institutional and private equity firms bought numerous distressed homes in geographies where prices were most impacted due to the downturn. They built operating businesses around these portfolios that focused on acquiring, rehabilitating, leasing and maintaining these properties. Many are organized as real estate investment trusts.

In most cases, the sponsor of an SFR securitization holds the most subordinate classes in the transaction. Typically, the sponsor is responsible for developing and executing the long-term strategy of the operating company and its ongoing capital requirements. Often, they also have internalized or affiliated property managers, who are generally responsible for rehabilitating, marketing, leasing, tenant credit verification, rent collections, evictions, responding to tenant requests and maintenance.

NEWSLINK: Describe notable credit or structural trends in SFR transactions.

MAHESHWARI: Loans that serve as collateral share certain structural similarities with securitized commercial real estate loans, as they are secured by first priority mortgage liens on the underlying properties. Except for certain standard events, the loans are typically nonrecourse to the borrower and mainly rely on property cash flow and value for debt service payments.

In contrast to typical commercial real estate loans, however, single-borrower SFR loans generally also include a guarantee by the equity owner of the borrower, which is secured by a pledge of its equity interest in the borrower. The guarantee is for the payment of all debt service and other monetary obligations to the lender when due, as well as the performance on all covenants, agreements and other obligations of the loan parties.

Around 69% of the single-borrower transactions have been collateralized by fixed-rate loans to date. However, the sector’s initial loans (and as a result, the related securitizations) were largely floating-rate until 2018. The determination of issuing fixed- or floating-rate securitizations may be dependent on both the needs and preferences of the sponsor’s overall financial strategy (some have issued only floating-rate transactions, while others have predominantly issued fixed-rate), as well as investor preferences and the prevailing spread environments.

The loan terms have ranged from three to 10 years (fully extended terms in the case of floating-rate loans). The most common loan term is five years for 81 transactions representing 73% of issuance by count and 74% of balance. The remaining transactions have had fully extended loan terms between six and 10 years, while one loan has a three-year term.

The sector’s earliest transactions (seven, 5% by total sector balance) included fixed amortization schedules in the amount of 1% annual amortization, paid monthly. Since then, all of the transactions have been collateralized by loans that have required interest-only payments during their terms.

Alternatively, multi-borrower SFR transactions to date have been collateralized solely by fixed-rate loans. The loan terms have typically ranged between five and 10 years. Loans are either full-term IO or amortizing balloons with principal payments during some or all periods during the term, which are based on 20- to 30-year mortgage amortization schedules.

NEWSLINK: How have loans in SFR transactions performed?

MAHESHWARI: To date the transactions have performed well. There are relatively few examples of distress or default given the overall economic environment and housing performance.For single-borrower transactions, none of the 113 loans securing these transactions have so far been delinquent or transferred to special servicing. 40 loans are fully paid off, while the remaining are currently outstanding and performing.

As far as multi-borrower transactions, of the 2,115 securitized loans, 904 loans (42.7% by count) have been repaid and 179 loans (8.5%) have been in special servicing at least once in their respective term as of July 2022. In addition, 12 of the sector’s 22 securitizations have experienced relatively small losses ranging from 0.01% to 1.2% of their pool balance at issuance.

Despite limited losses, loans in the sector exhibit a moderate rate of ongoing delinquencies similar to the conduit CMBS sector. On a cumulative basis, the 60-plus day delinquency figure in the 16 KBRA-rated CoreVest American Finance securitizations have ranged between 0% and 11.2%, with an average of 4.6%.

In terms of collateral property performance, KBRA notes the following trends observed for single-borrower transactions (multi-borrower transactions have less property level data available on an ongoing basis):

- Home price appreciation has generally been in line with appreciation in those regions and zip codes where the underlying collateral is located, with 15%-25% annual growth. The greater the seasoning of a transaction, the more the aggregate home price appreciation has been observed.

- Net operating income that has been higher than the sponsor’s initial underwritten figures in most cases.

- Actual operating expenses and capital expenditures, however, were often higher than the figures underwritten by the sponsors.

- In pre-COVID years, tenant delinquencies averaged around 0.6%, but that has since increased and currently averages at 3.7%.

- Conversely, tenant retention rates jumped to above 85% from around 70% pre-COVID.

NEWSLINK: Has there been much ratings volatility in terms of upgrades or downgrades?

MAHESHWARI: Ratings movement for SFR transactions has been positive, with no downgrades to date. KBRA has assigned ratings to 609 classes across 70 single-borrower SFR transactions and 17 multi-borrower SFR transactions, of which 143 ratings have been upgraded. The single-borrower upgrades have primarily been driven by the robust home price appreciation experienced over the last decade, along with increasing portfolio cash flows. In the case of multi-borrower SFR and certain single-borrower SFR transactions, upgrades were mainly driven by deleveraging of the capital structure owing to loan paydowns.

NEWSLINK: What factors is KBRA watching going forward that may impact SFR market?

BHASIN: While performance has been extremely positive and this success has built upon itself over time, headwinds have been gathering with rising financing costs, uncharted inflation, elevated geopolitical risks and increasing concerns about a general economic recession.

Higher borrowing costs can cut both ways–for SFR property owners/sponsors, it reduces levered returns unless there is a downward correction in property prices; for potential homeowners who are currently renting, it makes homeownership less affordable, thereby keeping them in the tenant pool that may rent SFR properties.

In contrast, inflation may put pressure on sponsors’ operating margins as the cost of materials and services to operate their businesses rise, particularly if they are unable to pass these increased costs to renters. If the consumers’ credit quality starts to exhibit significant weakness, tenant delinquencies could rise further. In addition, if the trend of working remotely reverses, that could lead to lower SFR demand.

Should these factors lead to meaningful declines in home prices, rental rates, and/or operating margins, the sector will be subject to stress it has not previously encountered. If a transaction experiences distress under such a scenario, its workout may be complex and present several challenges. The nature of the loan and related collateral may limit the universe of buyers willing to purchase the loan in a distressed situation, and substantial workout negotiations may be required to restructure it.

In the event the special servicer elects to pursue foreclosure, it is likely to be a lengthy and costly process due to the large number of properties securing the loan and the variety of jurisdictions in which such properties are located. State laws may limit the special servicer’s ability to accelerate the loan, to enforce the equity pledges and/or to fully realize on deficiency judgments, all of which could result in losses to the certificateholders.

Furthermore, since the properties are subject to leases, it is possible that workout periods may be longer, while loss severities may be more extensive than in typical RMBS transactions. It remains an unknown for single-borrower SFR transactions, as not a single loan has been transferred to the special servicer and experienced a workout. While multi-borrower SFR loans have experienced special servicing transfers and defaults, the number is relatively small, and they have not yet resulted in meaningful write-downs of subordinate securities.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)