July Construction Spending Tapers

Construction spending fell in July, marking the second consecutive monthly drop, the Census Bureau reported Thursday.

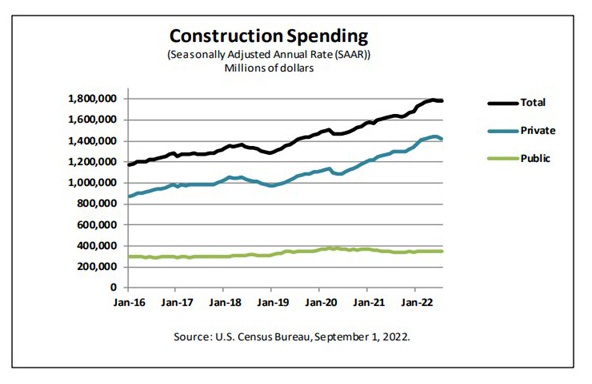

The report said total construction spending fell to a seasonally adjusted annual rate of $1,777.3 billion, 0.4 percent lower than the revised June estimate of $1,784.3 billion, but 8.5 percent higher than a year ago ($1,637.3 billion). During the first seven months of this year, construction spending came in at $1,013.7 billion, nearly 11 percent higher than the $915.2 billion for the same period in 2021.

Spending on private construction fell to a seasonally adjusted annual rate of $1,424.2 billion in July, 0.8 percent below the revised June estimate of $1,436.4 billion. Residential construction fell to a seasonally adjusted annual rate of $920.4 billion in July, 1.5 percent below the revised June estimate of $934.4 billion. Nonresidential construction, however, rose to a seasonally adjusted annual rate of $503.9 billion in July, 0.4 percent above the revised June estimate of $502.1 billion.

The estimated seasonally adjusted annual rate of public construction spending rose to $353.1 billion, 1.5 percent higher than the revised June estimate of $347.9 billion. Educational construction fell to a seasonally adjusted annual rate of $77.2 billion, 0.1 percent below the revised June estimate of $77.3 billion. Highway construction rose to a seasonally adjusted annual rate of $102.7 billion, 4.3 percent above the revised June estimate of $98.4 billion.

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., said despite an upward revision to overall spending in June, the increase in non-residential construction was not enough to offset the decline in residential construction.

“Total residential spending is still up 14.0% over the year; however, the drop-off in home buying brought on by higher mortgage rates is weighing heavily on the residential sector,” Vitner said. “Rising building material and labor costs have likely boosted overall spending, which is not adjusted for price changes.”

Vitner said this year’s sharp increase in interest rates is starting to weigh on the construction industry. “The pull-back in spending has occurred against a backdrop of sharply higher mortgage rates which has worsened affordability and pushed prospective home buyers to the sidelines,” he said. “New home sales and home builder sentiment have moved markedly lower in recent months, and builders are now starting to scale back production alongside lower demand.”